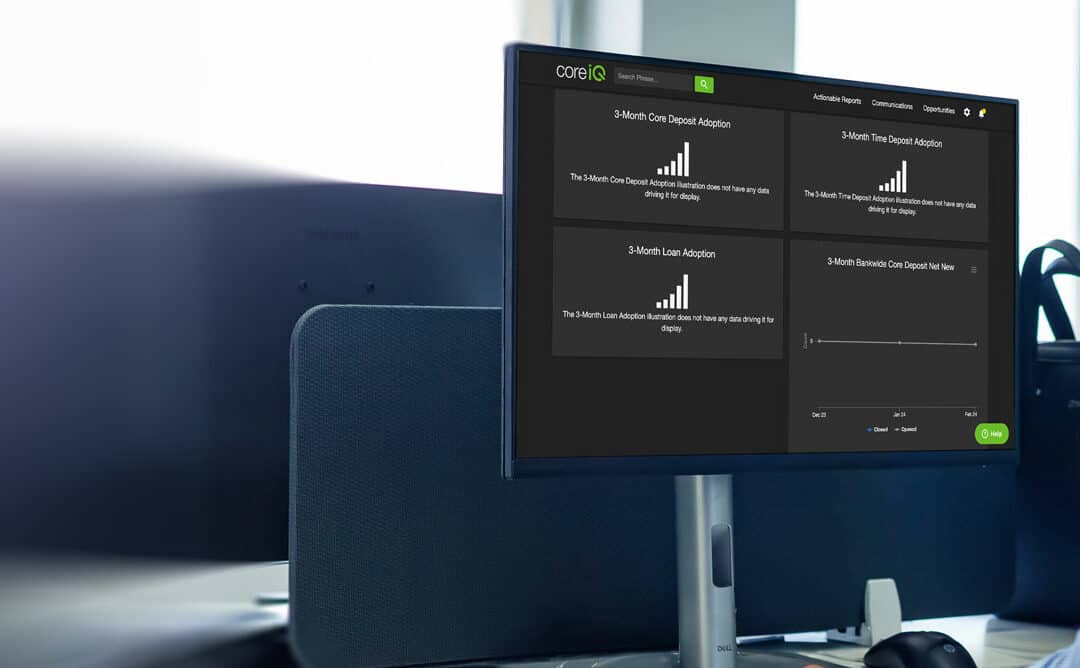

In the competitive financial services arena, staying ahead requires innovation and a partnership that fosters trust, understanding, and shared goals. EP Federal Credit Union found such a partnership with Onovative, and at the heart of this alliance is Core iQ, a...