Savings account promotions are essential to increasing deposits at your bank or credit union. As a marketer, you’re constantly working to learn account holder habits to meet your annual deposit goals. We’re here to help, so you can offer the right savings account product at the right time.

According to a Google search trends analysis the optimal time to promote your regular and premier savings accounts products is between January through March. But, we want to equip you with the right tools you need to get your savings account promotions ready to launch at a moments notice.

Timing Your Offer

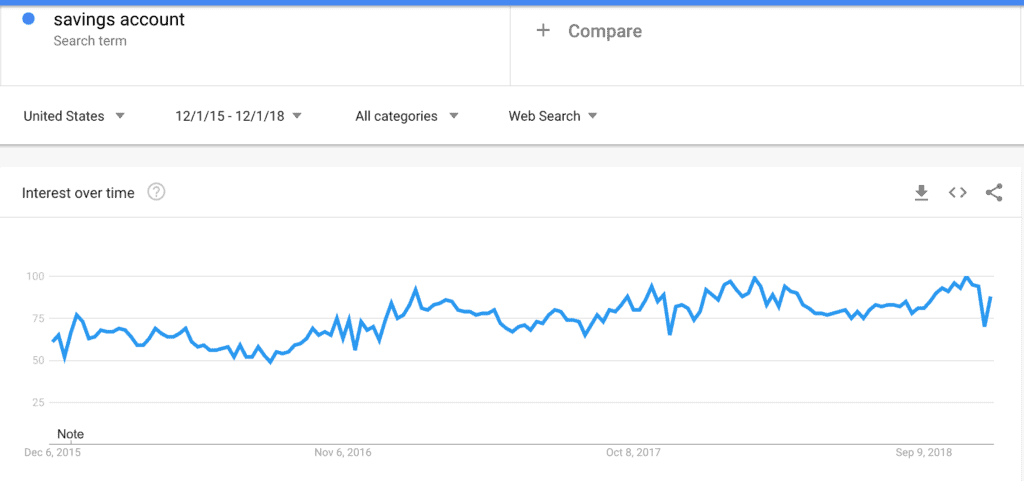

Finding the best time to send any promotion is the key to any financial institution marketer’s success. Using Google Trends can give you insights into when most people search for savings accounts.

Google Trends shows the relative search volume over time for a specific term or phrase, making it a reliable tool for marketers to use to determine the best time to promote a specific product offer.

As you can see, the phrase “savings account”, when observed over the last three years, shows a rise in interest at the beginning of January, falling in March, and then another spike in October, falling at the end of November.

With this data, financial institution marketers can deduce that sending savings account promotions during these times will produce new savings account relationships to help you reach your deposit growth goals.

Building Your Offer

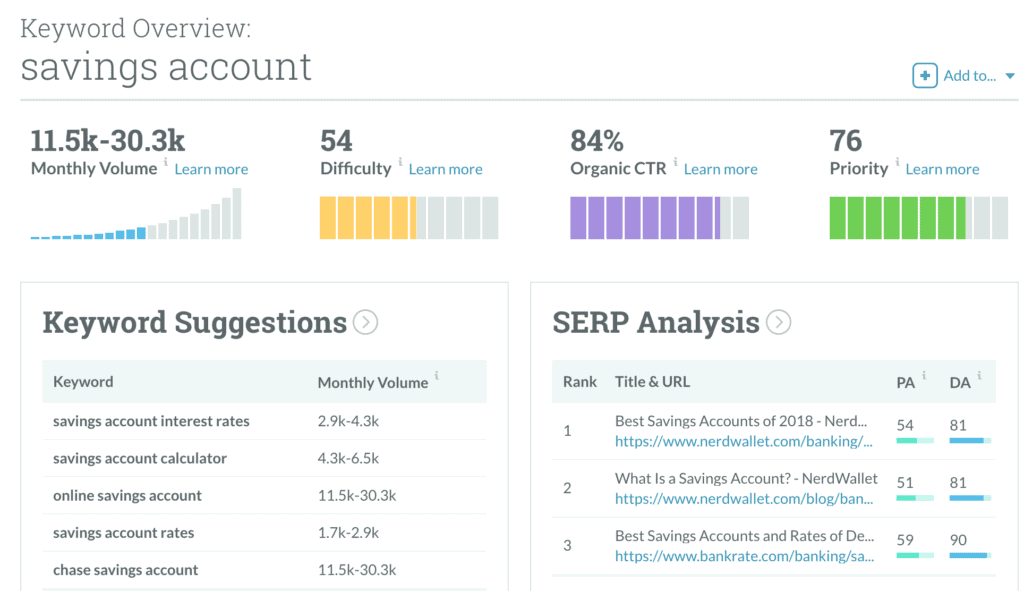

Now that you know when you should send your savings account promotions, you must determine what you will include in your savings account promotions. Your savings account offer must be competitive and attractive to your account holders so it’s good to know what they specifically look for when considering opening a new savings account.

Tools like Moz or Google AdWords show how often a search term or phrase is searched in Google each month, giving you unique insights into the specific features that are important to your customers and members when it comes to savings accounts. For example, when we plug in the term “savings account”, we are given a list of related searches with high search volume:

- Savings account interest rates

- High yield savings accounts

- Online savings account

These related searches indicate the savings account features consumers care about, and should be considered when creating your offer and promotional messaging that goes along with your savings account campaigns.

Analyzing Big Bank Examples

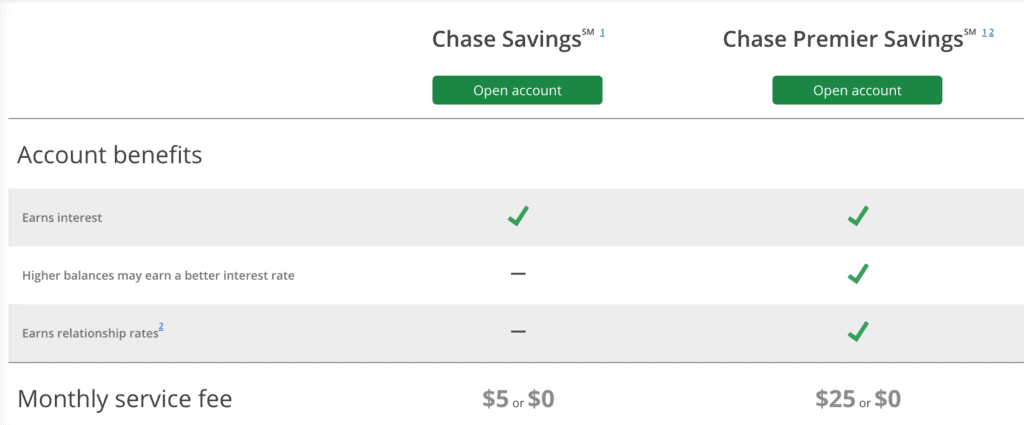

Offering competitive rates and prominently displaying them in your offer will also help to make your promotions attractive. Let’s look at one example from a top bank’s successful savings account promotion. Chase’s savings account promotions clearly show the benefits and rates associated with each of their different savings accounts. The chart shows the differences between their regular and premier savings accounts, which are:

- Differences in interest yield

- Differences in relationship rates

- Differences in fees associated with each account type

Breaking down the differences in savings accounts allows prospective customers to easily determine which savings account offering makes the most sense for their unique financial situation.

Now that you have the insights you need, you can get started creating your own targeted savings account offers. Using a communication platform, like Core iQ, can help you easily create and send highly-targeted automated communications using your core data.