Capturing new checking accounts, whether from totally new relationships or from existing relationships, can be a challenge for financial institution marketers. Once you’ve conducted your initial research to determine what and when to market to set you apart from other financial institutions, it can be helpful to see what can be learned by some of the big banks by looking at what they are doing when it comes to checking account promotions.

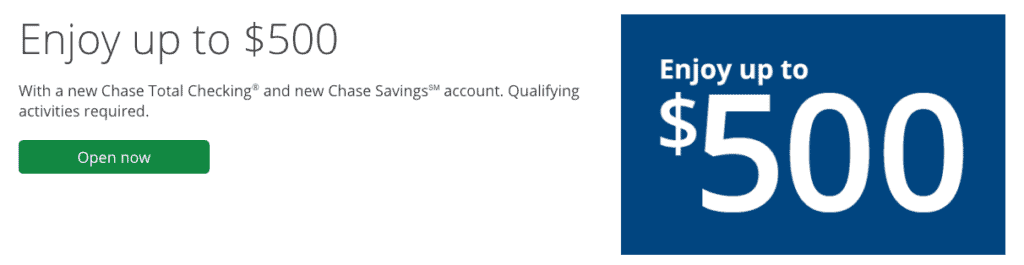

Chase

We know it can be a major hassle to switch institutions, so if someone doesn’t have an immediate reason, like a recent move or marriage, they will likely need a major incentive to get them to switch financial institutions. Offering something like cashback, like Chase is doing, is a common practice among financial institutions to incentivize potential relationships to open a new checking account with them. There are usually varying levels of cashback opportunity depending on qualifying activities, but as you can see, this offer is prominently positioned on their checking accounts web page.

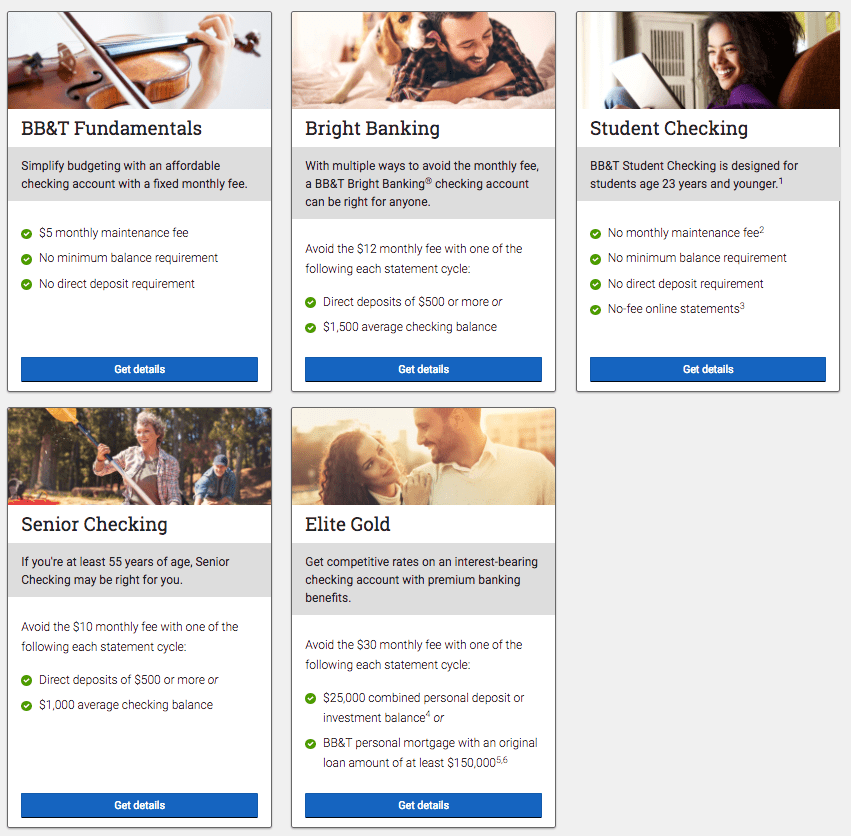

BB&T

Financial institutions typically offer multiple types of checking accounts. When a potential relationship is looking to open a new checking account, they want to know what their options are, the benefits of each, and any necessary qualifying activity. When you navigate to the checking accounts page on BB&T’s website, you see each of their checking account options clearly defined with specifics about each account and who qualifies for each. Clearly outlining each of your checking account types can help potential relationships determine which account type would be best suited for them based on their deposit and spending habits. Does the account have a minimum balance? Is there a no-fee option? What is the direct deposit minimum? These are the questions your audience will be asking, so putting the information right in front of them will increase your ability to drive new checking account conversions.

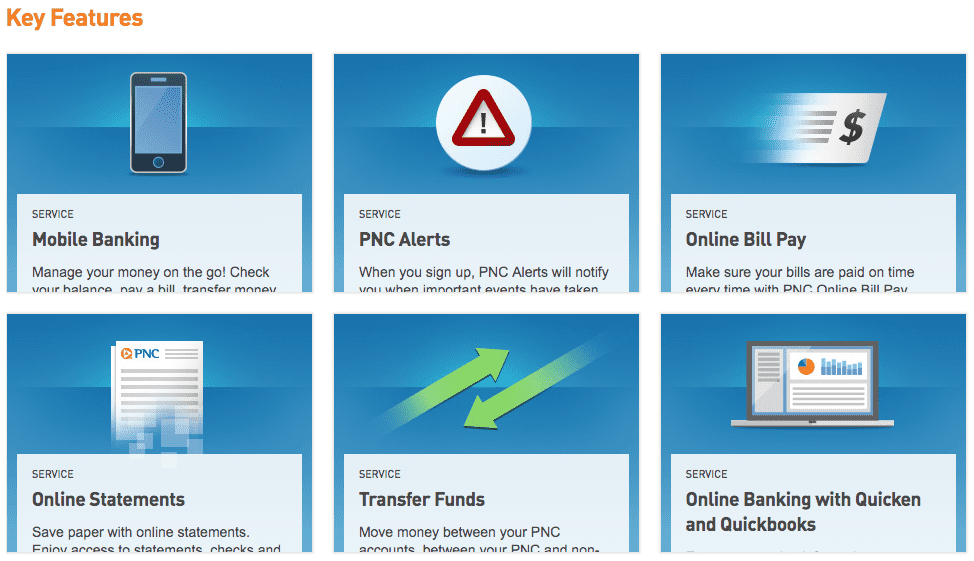

PNC Bank

One of the draws to opening checking accounts with financial institutions are the go-with, or additional products offered along with the accounts. Things like online banking, mobile banking, mobile deposit, and bill pay, are a few of the more popular features. If your financial institution offers things like this, it could be helpful to highlight your go-with products and services in your checking account promotions. This is exactly what PNC Bank has done on their website, where they have prominently displayed each additional feature that is available when banking with them. If you offer additional features, you definitely want all of your checking account relationships to participate in them. So, instead of having to cross sell all of your go-with products after the fact, introduce them on the front end to generate interest early and often.

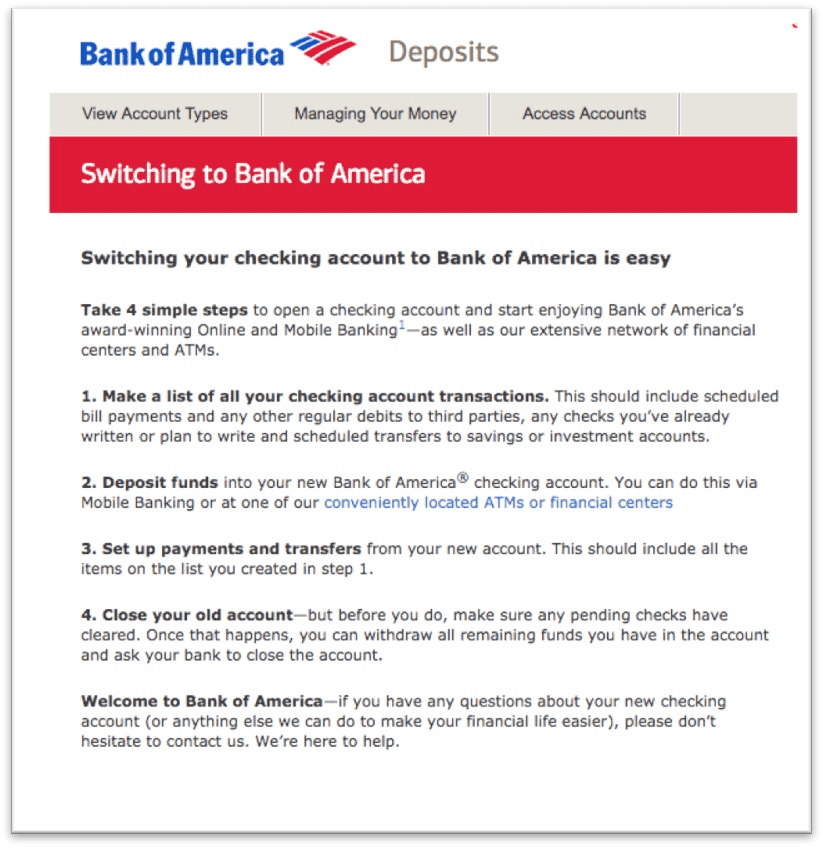

Bank of America

It’s never an easy task to switch financial institutions. Most individuals may not even know where to begin when it comes to closing one account to open another. Taking some advice from some of the big banks, like Bank of America, when it comes to aiding new relationships with a switch is good practice. People like simple, actionable items and checklists. So, when you outline a simple step-by-step of how to switch to your financial institution, you open the door for new relationships to trust you and look to you for an easy experience when it comes to switching their primary financial institution. Offering a “switch kit”, or something like what Bank of America has done, is a great content idea for your checking account campaign.

It’s good to look at what large financial institutions are doing, when it comes to promoting new checking accounts. This is an easy way to verify the content and messaging strategy behind your own campaigns, and it can likely help you bring in additional new accounts.