Since the majority of individuals don’t change who they bank with very frequently, it’s important to understand why and when someone would switch financial institutions when trying to effectively capture new checking account relationships. Other than being dissatisfied with fees or rates, what are the most common reasons?

Asking yourself these questions can help to narrow down the optimal time to send out checking account promotions. So, what are some of the reasons why people switch financial institutions? The truth is, switching can seem like a daunting task for most, so unless there is incentivize to switch financial institutions, it’s mostly common when relocation or marriage/opening of a joint checking account play a part in the decision.

If you’re trying to capture totally new checking account relationships, capitalizing on the timing of these events is a good place to start. So, when do most people relocate or get married? Families typically move in the spring and summer months; usually before or after the school year and when the weather will most likely be ideal. Wedding season typically falls during this same time, ranging from spring through end of summer. These are important events and timeframes to keep in mind when planning your new checking account promotions.

Next, let’s take a look at Google Trends and see what insights we can glean from when people are looking for new checking accounts and switching financial institutions and see how that correlates with our initial hypotheses.

Google Trends is a free tool that can be used to measure the relative interest over time for specific keywords and phrases. We will be looking at the top keywords and key phrases we identified during our initial keyword research for planning checking account promotional campaigns:

- How to switch banks

- Best checking accounts

- Best checking account offers

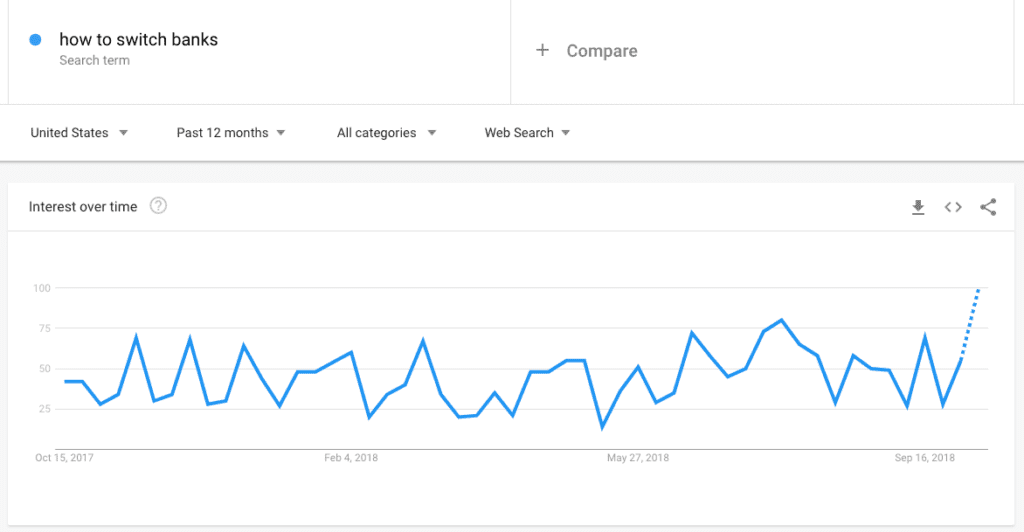

The first search phrase we will look at is “how to switch banks”. The following screenshot shows the relative interest of the search phrase over the last 12 months. From the graph, we can see there are spikes in interest during the following date ranges:

- March 4-10

- June 17-23

- July 15-August 4

- November 12-18

- December 3-9

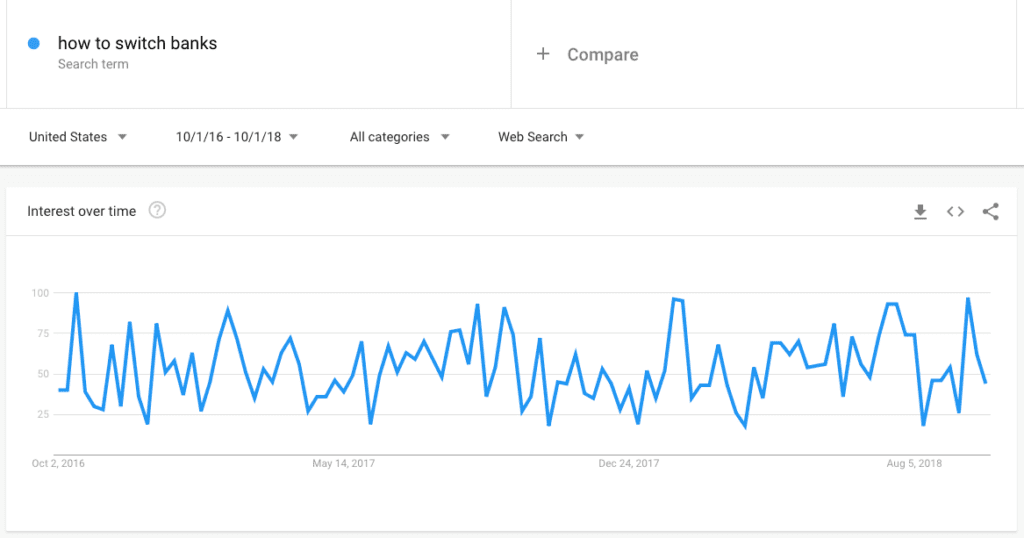

Now, let’s adjust the time frame to show the last 24 months and see if there are any additional patterns to note.

Looking at the data for the last 24 months, we see the following spikes:

- February 12-September 3

- August 27-September 2

- June 17-August 4

- November 27-December 3

These results show there is consistency in the rise of interest from February 12 – September 3 in “how to switch banks”, with only a couple of small declines. This data also coincides with the timeframe for when people are said to typically relocate and the traditional wedding season.

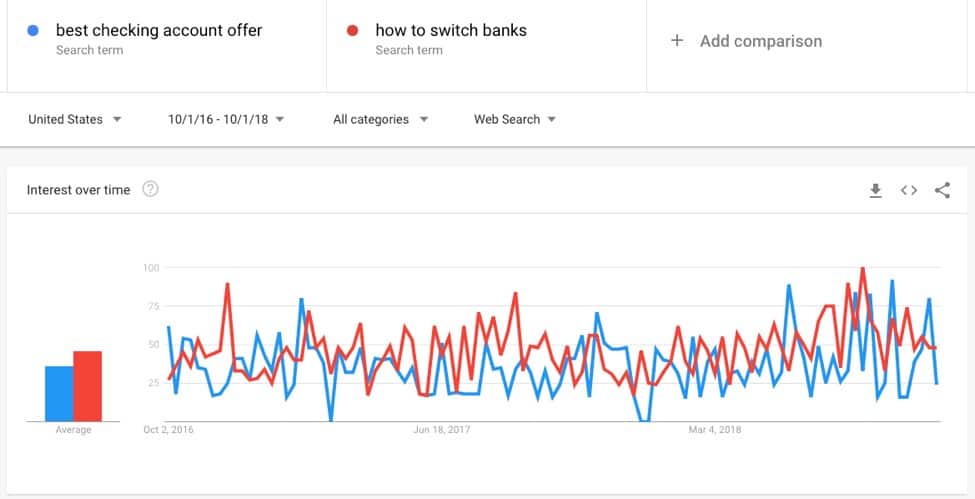

The next key phrase we identified during our initial research is “best checking account offer”. The following graph shows the relative interest of that phrase over the last 24 months, and we see the following spikes:

- February 5-11

- November 12-18

- May 13-19

- July 15-August 25

- September 23-29

When we compare the relative interest of the two search phrases, we can see that the data follows a similar peak pattern.

From this Google Trends research, we can conclude that there are some seasonal correlations between when people typically relocate and when people are searching online for new financial institutions. According to the trends research, the relative search interest is the highest between the weeks of March 18-24, May 14-May 20, June 17-23, and August 13-September 2.

Use this information to plan your checking account promotional campaigns to begin before peak interest times, giving you an opportunity to capture those new relationships when they first begin researching new banking options.