A 628MM credit union set out to grow new loans by promoting a holiday personal loan offer to 34,000 of its members in good standing.

The results of their campaign show that sending a simple, two-email personal loan offer utilizing Core iQ can easily generate 150X return with the right offer, timing, and audience.

The Audience

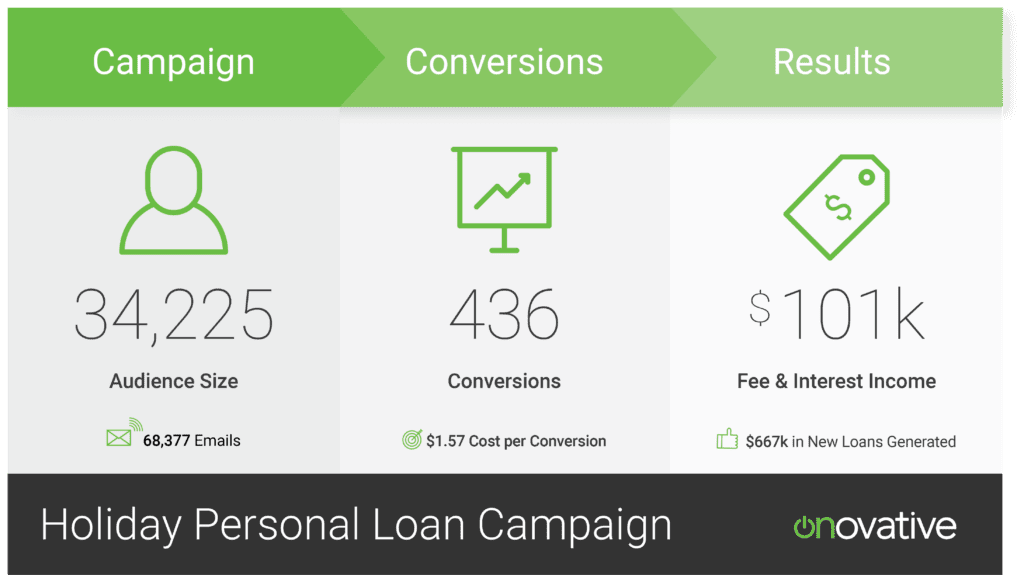

The credit union segmented 34,230 of its 58,000 members who they determined were in good standing. These members included individuals who have never defaulted, charged off, missed a payment, and who are not currently paying on a personal loan with the financial institution.

While many financial institutions are hesitant to send a campaign offer to an audience of this size, their results have shown that it was well worth the time and investment as the campaign generated 436 new personal loans.

The Offer

The promotion was simple – a $1,000 personal loan with 0% interest and a $95 loan processing fee.

While this highly-competitive offer may initially seem unfeasible for some credit unions, when you look at the revenue generated from the campaign you’ll see that the credit union made 150x their initial investment, making up any money spent, and then some.

All that was needed were two, simple emails using Core iQ’s marketing automation platform and an audience segment based on custom criteria to define eligibility for the offer. They sent the two emails out during the span of one month, highlighting only the personal loan offer and terms, suggesting this would be a good opportunity to finish up any last minute shopping for the holiday season.

Their results indicate that the holidays are a great time for credit unions to offer personal loans, when individuals and families are trying to stay within their holiday budgets but could use some extra cushion.

The Results

The results for this credit union became two-fold. While they spent a total of $685 by blasting a large number of members, they generated 436 new loans at a 1.3% conversion rate.

Here’s the breakdown:

358 of the conversions actually took the $1,000 personal loan offer, generating $358,000 in new loans with the credit union bringing in $34,010 in fee revenue from the offer alone.

But this is where it gets good. 78 of the 436 conversions took out a different personal loan with a higher interest rate. Loan origination for these conversions totaled $309,566 – and the credit union stands to make $67,653 in interest income over the next three years.

At a penny per email, the campaign cost $683.77 to send through Core iQ. And this small investment resulted in $667,566.91 in personal loans generated and $101,663.63 in fee and interest income with very little time and effort.

In the end, this simple two email campaign generated a 150x return on investment and ultimately pays for Core iQ for the next 13 years.

Do you want to spend minimal energy and generate the same results for your credit union? Contact Onovative today for more insights on specific use-cases and strategies for how you can execute the perfect holiday personal loan campaign.