Our bank and credit union clients frequently ask us how other financial institutions are engaging members and customers that come in through indirect lending channels. This may be one of the biggest challenges that I hear marketers face, and in a lot of cases, relationships like indirect auto loans may never have any further contact or engagement with the institution. There is lots of discussion around the proper ways to onboard these types of relationships, but one opportunity many institutions may be missing out on is the impact a valuable cross-sell can have.

A $260.9 million dollar credit union was able to target their indirect auto loan members with a personalized cross-sell offer using Core iQ and increased deposits with 116 new personal checking accounts.

The Audience

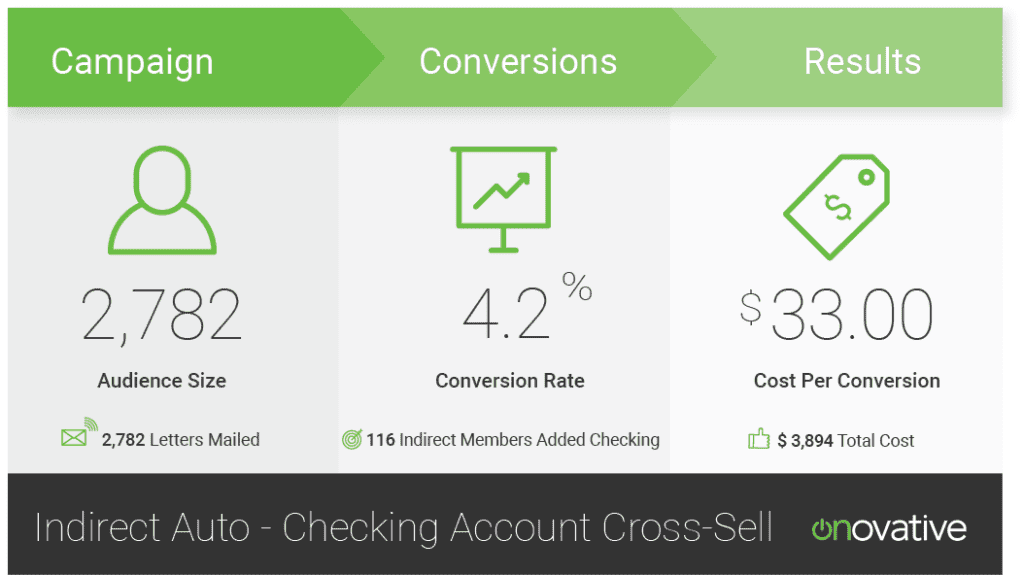

Since Core iQ connects directly to your core banking system and is updated with a nightly refresh, the credit union was able to quickly segment a list of all of their relationships that had an indirect auto loan but no other products or services. They then sent out 2,782 direct mail letters to this audience with their personal checking account offer.

The Offer

The credit union implemented some highly-successful marketing tactics within their checking account cross-sell offer that had a great impact on their conversion rates.

They used phrases like, “With your new auto loan, you’re now eligible for…” This kind of language adds a sense of exclusivity that is attention-grabbing and shows added value to their current auto loan product.

They initially promoted their premium checking account with a monthly service fee. They highlighted all of the extra features and benefits associated with this account, outlining its increasing value. They also included information on their free checking account for those who “prefer a totally free account”. By approaching their offer this way, they were able to generate the maximum amount of conversions by appealing to the unique needs and interests of the largest audience possible.

While they sent their offer via direct mail letter, they included a QR code that could be scanned to quickly and easily learn more about the offer they were promoting. By combining these two tactics, they had a multi-generational appeal. While more Millennials and Gen-Xers prefer email as a form of communication over Baby Boomers, the QR code gave a sleek digital addition that would appeal to younger generations.

The Results

With this targeted cross-sell campaign, the credit union was able to generate 116 new personal checking accounts from their indirect auto loan relationships. Many financial institutions don’t know where to start when engaging these indirect relationships, however, this cross-sell campaign had a very successful 4.2% conversion rate. The campaign cost the credit union a total of $33 per conversion, but they now are successfully converting these 116 new checking account holders into multi-product members.

Now that these 116 indirect auto loan members are locked into that second account, the credit union can begin cross-selling all of their ancillary products like online and mobile banking, bill pay, direct deposit, eStatements, and then continue cross-selling the relationship into savings and additional loan products. The opportunity to turn indirect lending members into fully-engaged relationships with four or more products increases the likelihood that they will become a long-lasting, loyal relationship.

For more insights on how Core iQ can help you expand your indirect lending relationships, contact us at 20****@on*******.com“>in**@on*******.com or sign up for a quick demo.