Establishing Consistent Communications

So, why are financial institutions hesitant to use email as a frequent form of communications?

While some financial institution marketers are worried about sending “too much email”, they may be leaving high-reward opportunities on the table. In the email marketing realm, the word “cadence” refers to the timing, content, and audience of a specific campaign. Often confused with “frequency”, cadence refers specifically to when a customer or member receives a specific communication about a specific product offering.

In other words, as long as you’re sending valuable content and timely product offers to your customers and members, you won’t run the risk of losing anyone to unsubscribes. Instead, you’ll continue to build trust and brand recognition and gradually expand your existing relationships over time.

Consistency is key when it comes to establishing your email marketing cadence. When your relationships can come to expect communications from you, the likelihood of them engaging with you is greater. And as long as your messaging strategy is tailored to your specific audience and reflects your relationships’ specific product stages, you’ll ensure a successful campaign.

What is the Perfect Email Cadence?

What is the magic cadence and how frequently should you be emailing your customer/member base? Unfortunately, there isn’t a “one size fits all” when it comes to determining the right email cadence for your specific relationships.

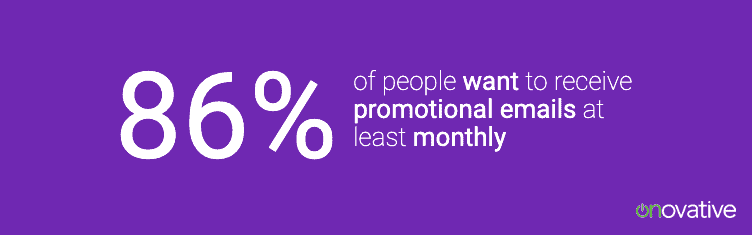

According to a survey by MarketingSherpa, 86% of consumers polled want to receive promotional emails at least monthly, while 61% want to receive promotional emails at least weekly. 9% of consumers polled want to receive promotional emails twice a month and less than 5% wish to receive only quarterly promotional emails.

According to this data, it is better to be sending promotional campaigns to your relationships on a monthly basis rather than only quarterly. The “sweet spot” for promotional email campaigns seems to be between 2 and 4 emails per month, as long as you’re sending targeted content that fits each individual relationships’ specific product journey.

However, it’s important to test and utilize your own insights to define your unique cadence when it comes to sending promotional emails to your customer and member base. If you’re only sending out a new promotion to your relationships once every three months, try gradually increasing the number of emails you send monthly and see if your conversions increase, as data suggests it will.

Communication platforms, like Core iQ, allow bank and credit union marketers to fully automate monthly, targeted emails and track opens, clicks, and conversions.