Personal phone calls should still be a staple of any successful bank or credit union’s marketing strategy. Not only do they add a personal touch and help to boost confidence in your institution, they are also a great and cost-effective way to promote your products.

Having a multi-channel marketing communication strategy is the best way to be where your relationships are.

A $304 million dollar credit union was able to generate $1.02 million in new auto loans with just one simple follow-up phone call.

The Audience

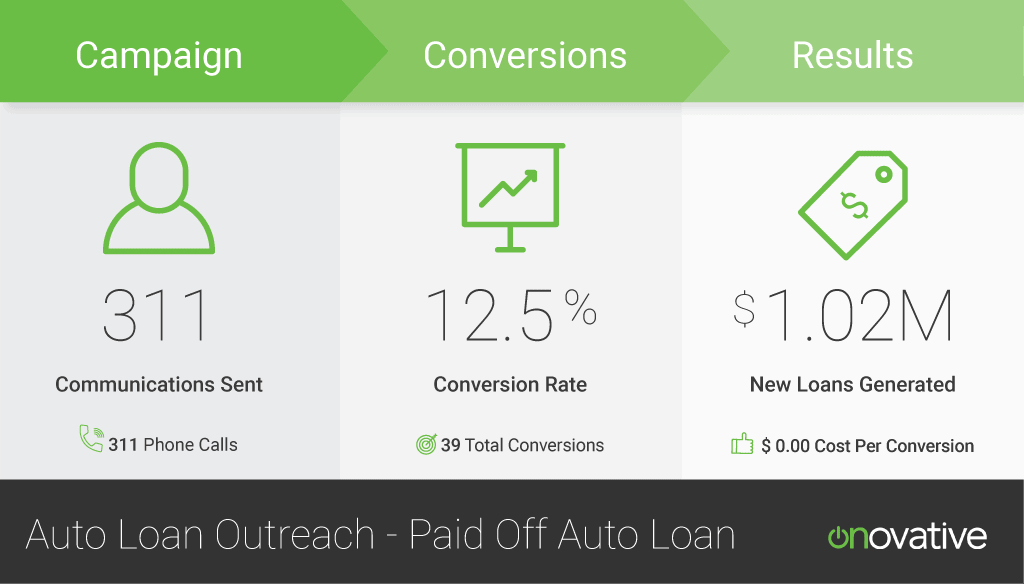

Utilizing Core iQ’s loan listing report, the credit union successfully identified 311 of their current members who had recently paid off an auto loan and executed a one-time follow-up phone call.

The Offer

The offer wasn’t much of an offer at all and more of a courtesy follow-up phone call. As we mentioned, the credit union called 311 of its members that recently paid off an auto loan.

Setting up this kind of phone call is important for a couple of reasons. The phone script was simple and they were able to do two things successfully:

- They congratulated each member on their recent triumph of paying off their auto loan. What a great move on their part to follow up with a member after something like paying off an auto loan. This was a great thing to include as a component of their member satisfaction efforts and positively adds to the member experience. By reaching out, they demonstrated that they value the relationship and are there to provide support and guidance.

- They re-engaged each member by asking if they could help with any additional loan needs. This was a great way for them to position their expertise, member service, and auto loan rates in front of their members – especially after they just paid off a loan.

The Results

With this phone call follow-up campaign, the credit union was able to generate 39 new auto loans at a 12.5% conversion rateand over $1.02 million in auto loan origination.

All from following up on recently paid-off loans.

Here’s the breakdown:

The auto loans that were generated took, on average, 28 days to convert. So what that means is within less than a month, the credit union grew loans over one million dollars. Of the 39 new auto loans generated, 76% were for over $15k.

The best part, the only spend on this campaign came from the utilization of internal resources to make the phone calls. The campaign itself didn’t cost the credit union a dime in marketing materials, and they were able to maintain a compliance work-flow of all phone scripts, queue up the calls to the assigned bankers, and track success, failures, and any notes all through Core iQ, their all-in-one marketing communication platform.

Interested in generating the same kind of results for your bank or credit union? Contact us today or sign up for a quick demo of Core iQ to see more use cases on how Core iQ can help reach your loan or deposit growth goals.