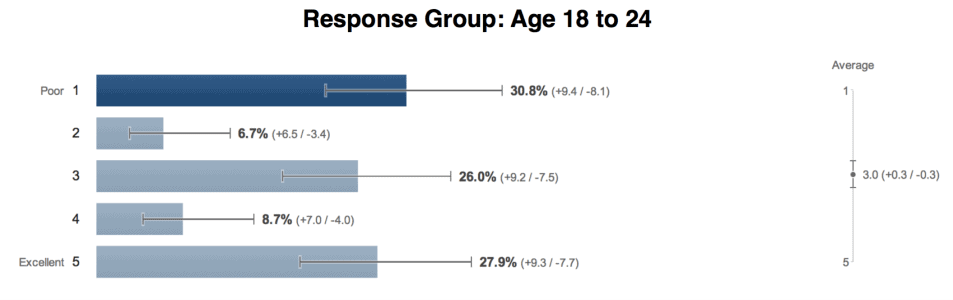

According to our most recent survey of more than 1000 customers of banks and credit unions, the youngest customers are the group least happy with the quality of online banking systems. Customers between the age of 18 and 24 were most likely to give their bank or credit union’s online banking system a rating of 1 on a scale of 1(poor) to 5(excellent). These results should provide financial institutions with clear signal that their systems are not meeting the expectations of a large portion of younger customers. The news is not all bad from the survey though. Customers between 18 and 24 had an average rating of 3.0, suggesting that opinions are widely split on whether online banking systems are meeting expectations./

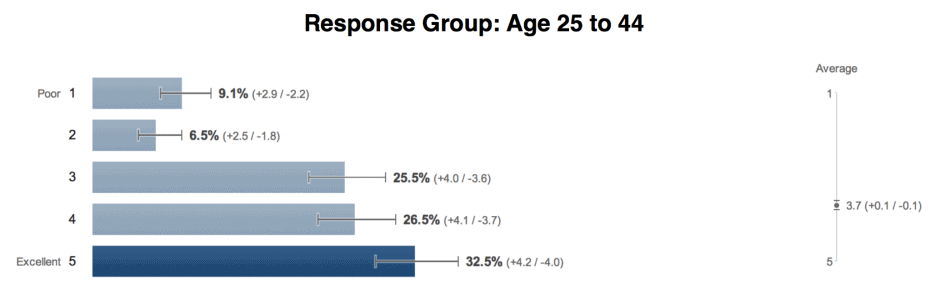

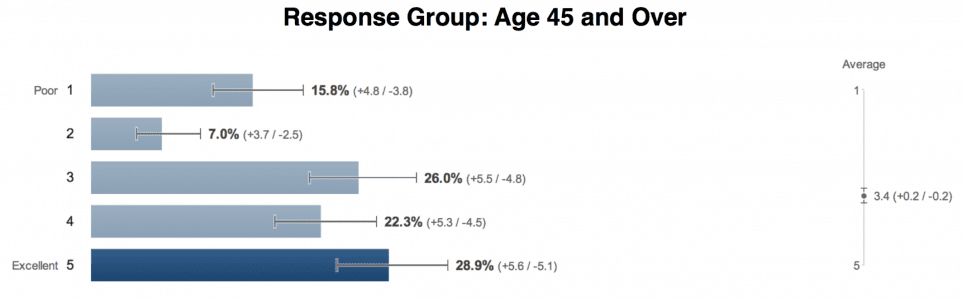

Older bank and credit union customers indicated a higher level of satisfaction with their institution’s online systems. Respondents between age 25 and 44 gave an average rating of 3.4 when assessing their online banking systems. While customers older than 45 rated the systems 3.7 on average.

We will be exploring this topic further in our upcoming posts. We will be looking into how income impacts customer satisfaction and be reporting on the opinion of customers on Mobile Apps and Online Bill Payment systems.