Customer satisfaction has always been an important aspect of business in every industry. In the financial industry in particular, it has become even more invaluable as customers face fewer and fewer switching barriers.

Primary Financial Services Providers (PFSP) have a longstanding goal of maintaining their current customers alongside gaining new ones and growing products per member. But as new technologies and companies continue to emerge in the financial industry, it is more likely that customers will abandon their current PFSP if they are unsatisfied or find better deals elsewhere.

According to the EY 2014 Global Consumer Banking Survey, the top reason customers either opened or closed an account was due to an experience with the financial service provider. The next highest being rates/fees. While 41% claimed that experience was the reason they opened their account, 33% say that it caused them to leave their PFSP. This is important for banks and credit unions to realize, because a positive customer experience is something every financial institution should have at the very core of their mission statement. These numbers indicate that some institutions are falling short on this, however, and it’s a direct cause of lost customers for them.

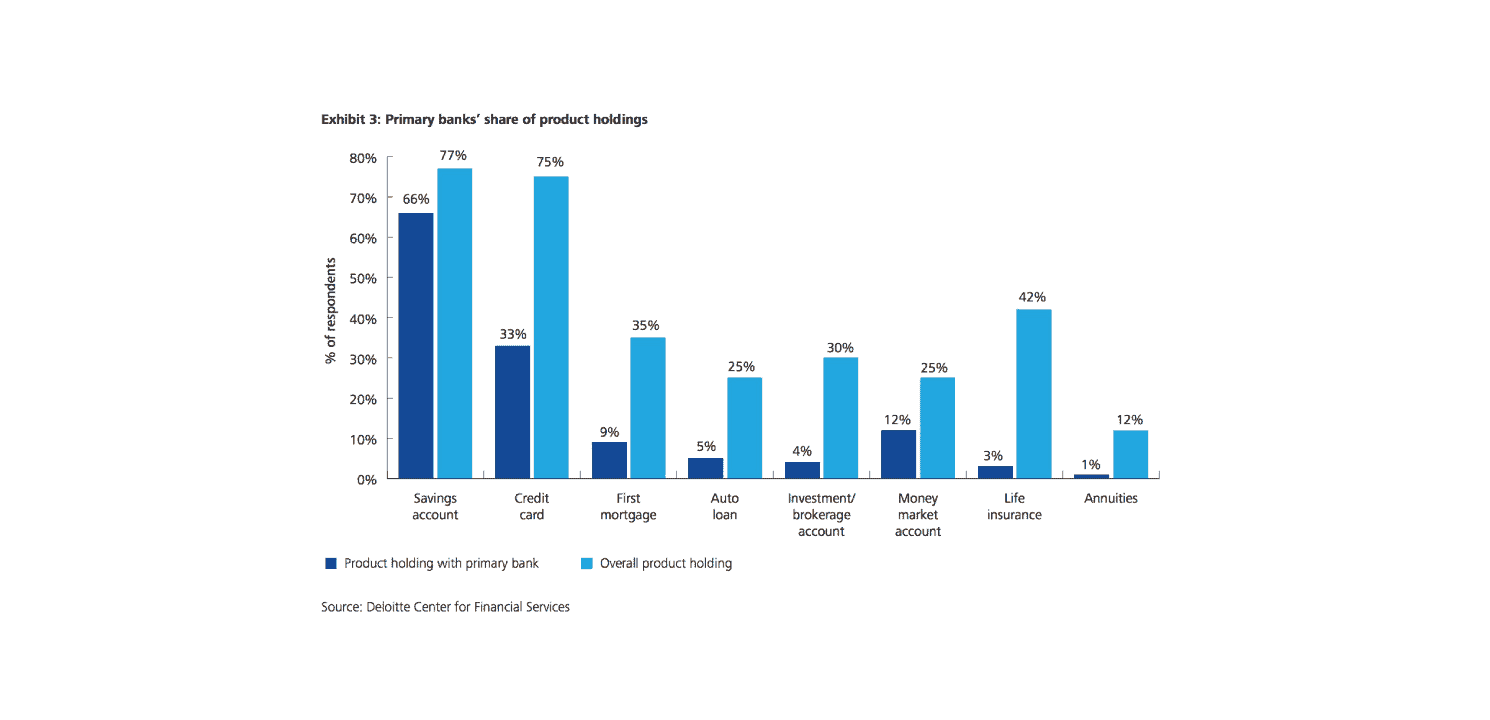

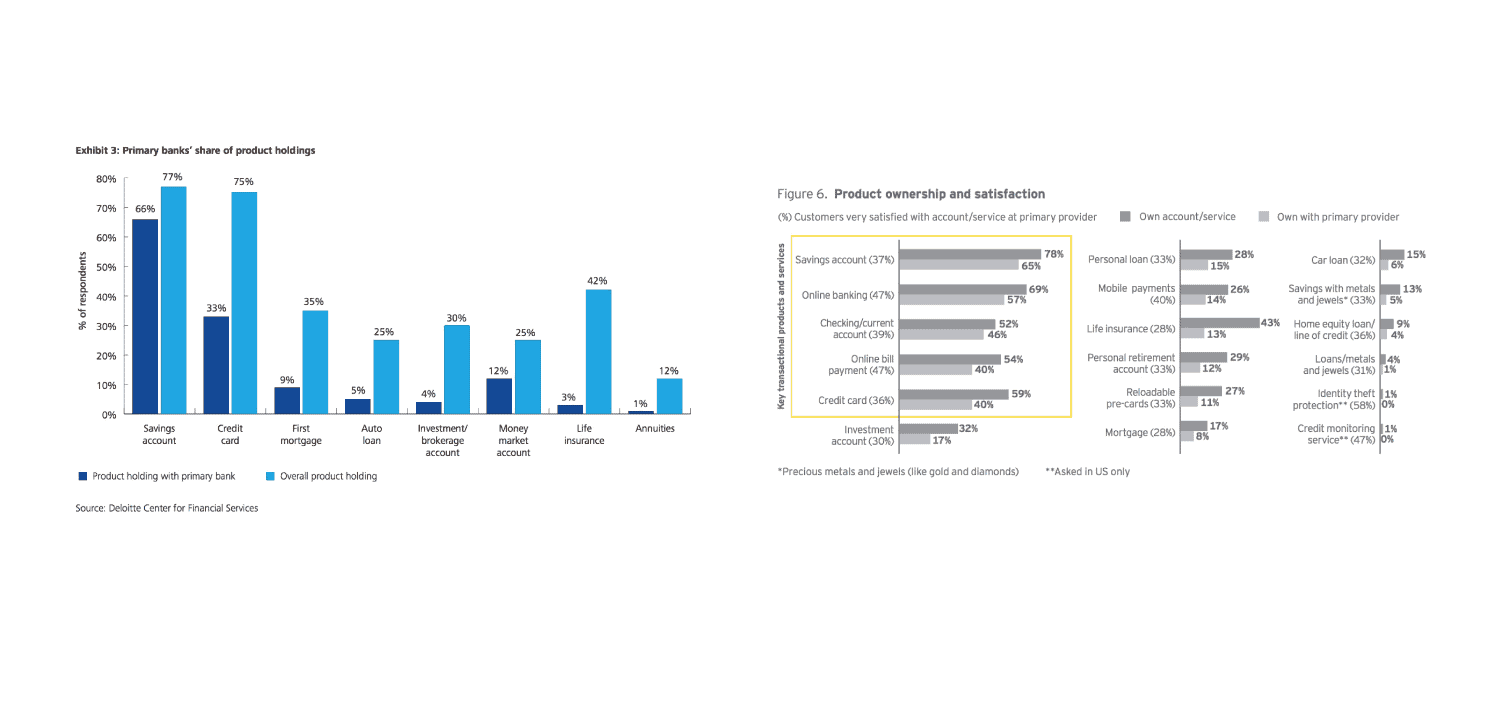

Even if customer satisfaction needs are met, there is still the reoccurring issue of customers going outside of their PFSP for additional financial services. According to a survey conducted by Deloitte Center for Financial Services in 2012, “Only 19 percent of retail bank customers owned three or more products in addition to a checking account with their primary bank, compared to 49 percent who have three or more products with other financial institutions.”

Making note of what products customers are more likely to have with the PFSP vs. what products they normally search for elsewhere is the first step in determining where more resources may need to be allocated. This article will cover some of those statistics as well.

There are numerous factors influencing customer behavior, some of which we may never know. The rest of this article will focus on what we do know: Customer satisfaction and experience is affecting whether a customer stays with their PFSP or looks to take their business elsewhere. Also, the number of additional products customers have with their PFSP is not as high as it could be and increased products per member can make switching institutions less appealing to customers.

By focusing on these two factors, satisfaction and products per account holder, we hope is to provide some valuable insights into how financial institutions can look at maintaining and improving their customer relationships.

What We Will Be Looking At

The EY Global Consumer Banking Survey conducted in 2014 includes responses from approximately 32,000 retail banking customers from 43 countries. Their survey report is very thorough and provides informative interpretations on their data involving the customer experience and more. I would highly recommend giving it a read if you have the time.

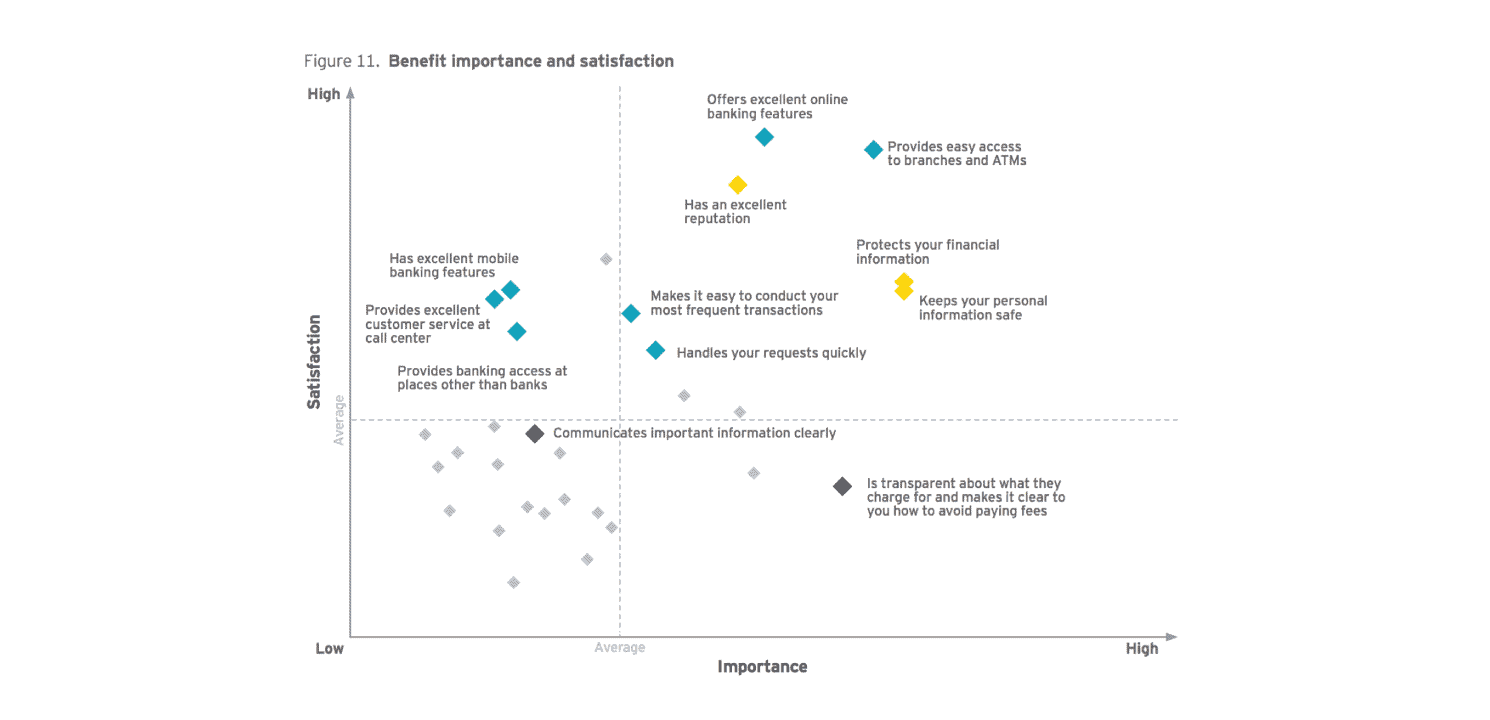

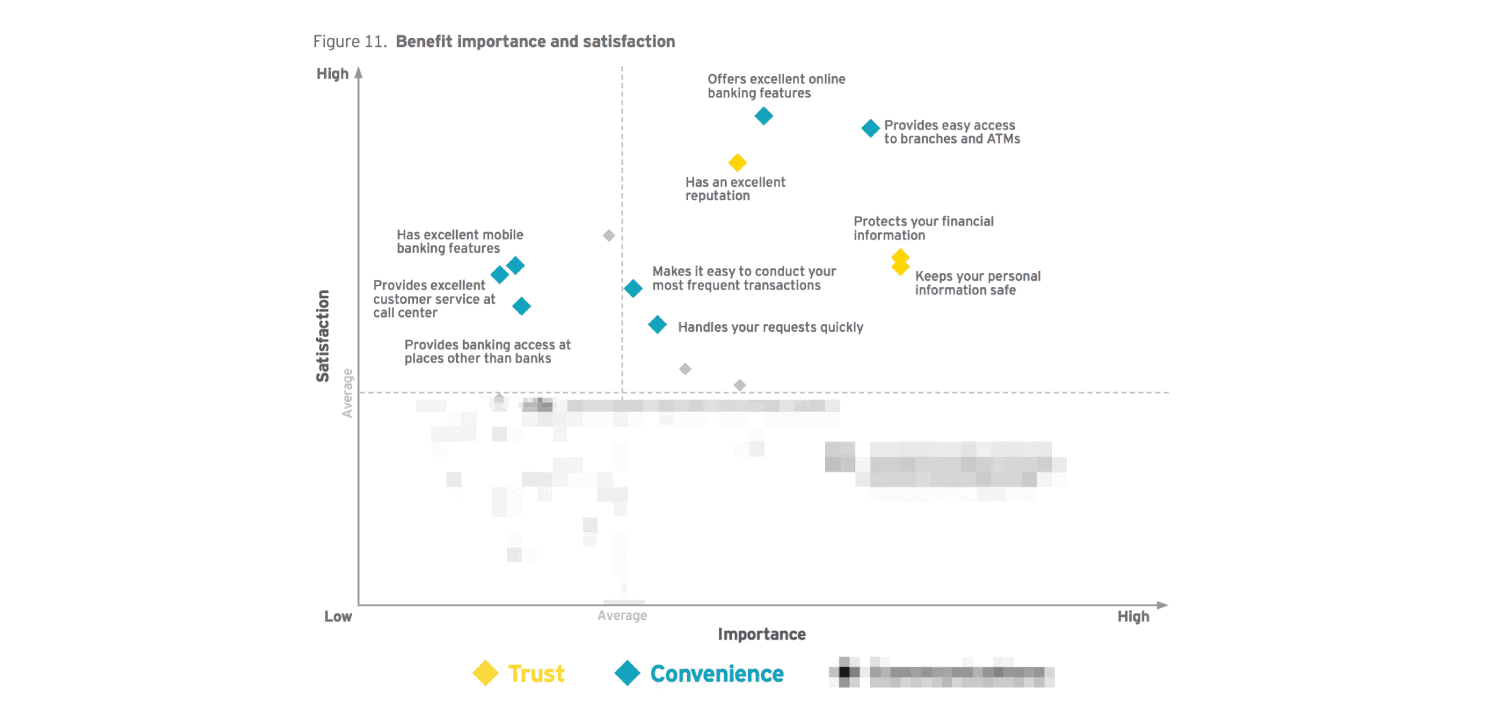

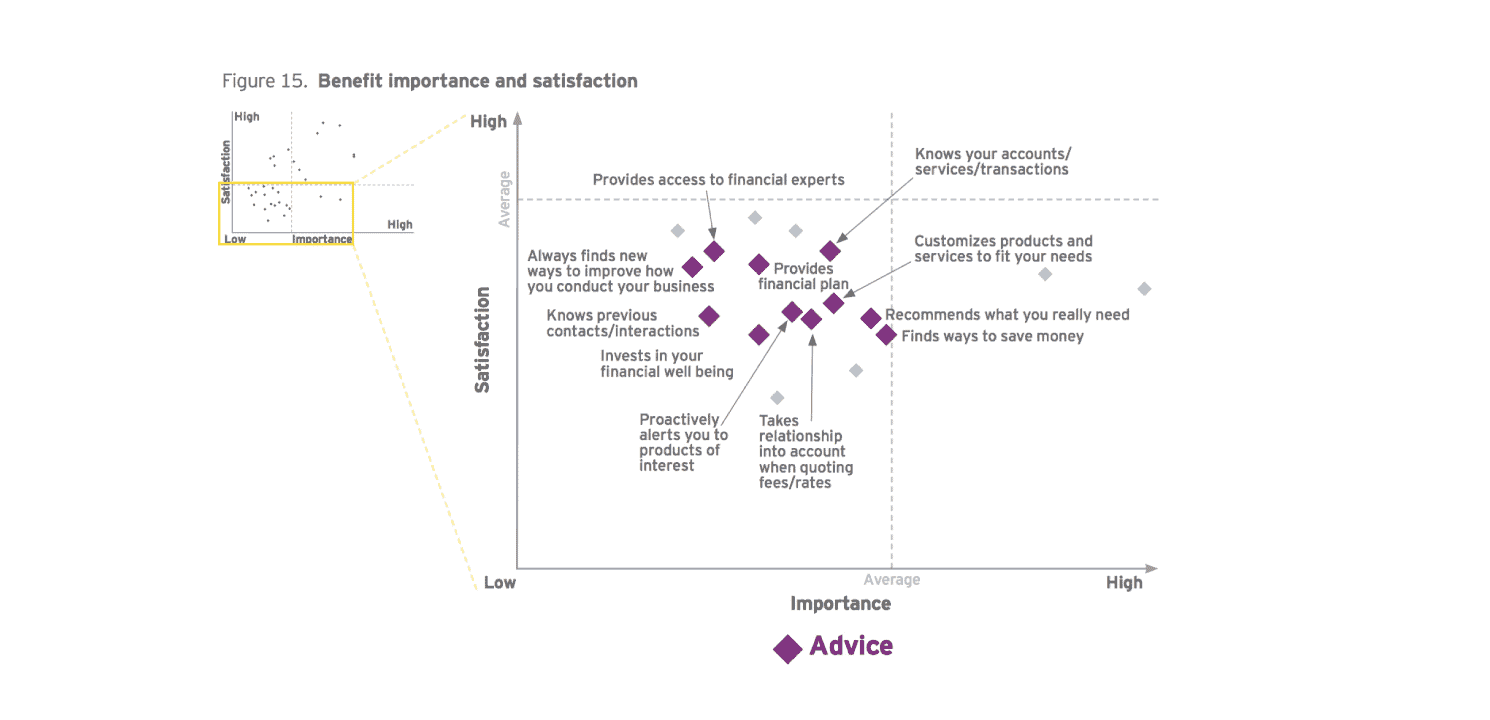

Part of the results of this survey included the graph shown below, which I will be referring back to throughout this article. The graph depicts the responses of those surveyed when they were presented with 31 benefits that could be expected of a PFSP. They were asked to pick the 5 most important benefits and evaluate their satisfaction with their current PFSP.

X axis = customer Importance Y axis = current Satisfaction Or: (Importance, Satisfaction)

From this graph, we will examine what benefits financial institutions are satisfying that are important to their customers and where they are falling short.

The survey report, as well as the Deloitte Center for Financial Services report mentioned earlier, include some numbers regarding products per account holder. We will look to these numbers as well for data on what products PFSP might be missing out on with their customers.

The Good New

First, let’s look at what important benefits rank above average in customer satisfaction levels with PFSPs:

As we can see from this graph, benefits involving trust and convince aspects of PFSPs have an above average satisfaction rating with customers. This is great news for financial institutions. Trust is hard to build, and being considered convenient isn’t an easy task either.

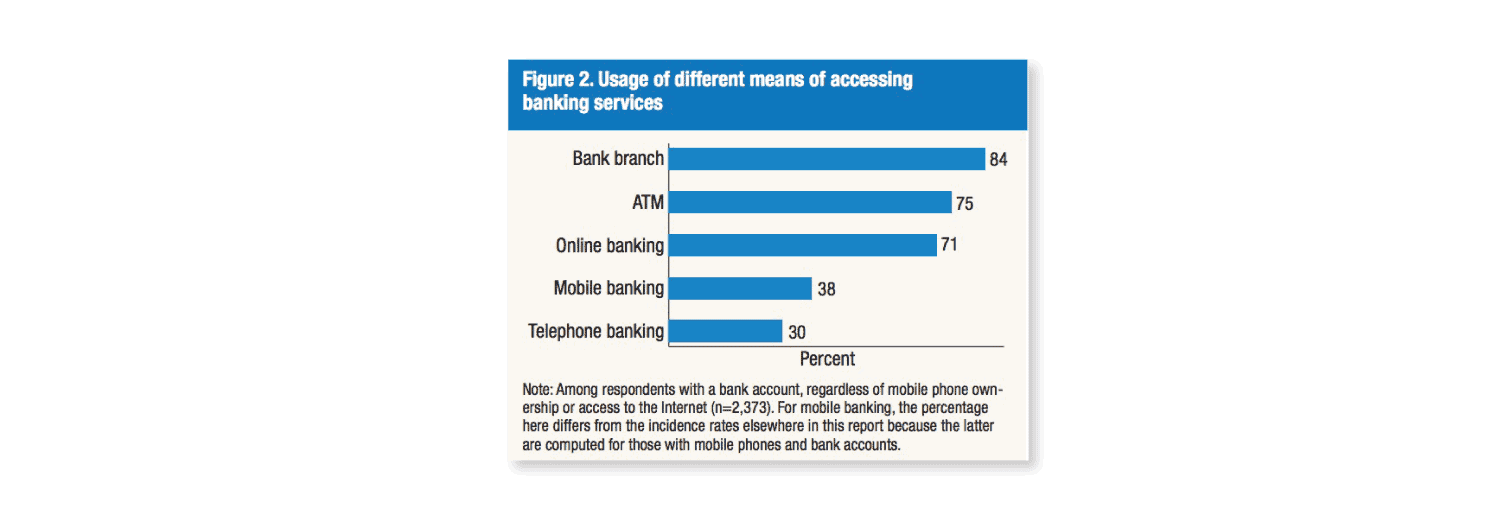

The benefit that carries the highest satisfaction rating is a customer’s PFSP Offering excellent online banking features. This is especially promising because the financial industry, along with practically every other industry, is becoming more and more digitally based. Research conducted by the Board of Governors of the Federal Reserve System on Consumers and Mobile Financial Services in 2016 showed that customer’s third-most common access with a financial institution in previous 12 months, at 71 percent, was through online banking. This percentage, as well as use of mobile banking features, is positioned to grow exponentially as the industry ages. So keeping satisfaction high with this particular benefit is important. This could be done by keeping up with online banking and mobile banking trends and changes/improvements in technology. Making sure your current technology is running smoothly and is user friendly is also important to maintaining customer satisfaction.

Another key takeaway is that customers indicated Protecting your financial information and Keeping your personal information safe as the two most important factors in dealing with their PFSP. It’s no surprise that the top two benefits involve trust and security. Keeping those benefits top of mind is vital for financial institutions. Not only that, but FIs should strive to make their satisfaction ratings even higher in this area. As technology advances, so must security measures. We’ve already seen advances such as the implementation of the EMV cards and increased cyber security. Maintaining strong security standards is a must if institutions wish to keep their customers satisfied. Make sure your third party vendors are up-to-date on all their security protocols as well and that your customer/member information remains safely behind your institution’s firewall.

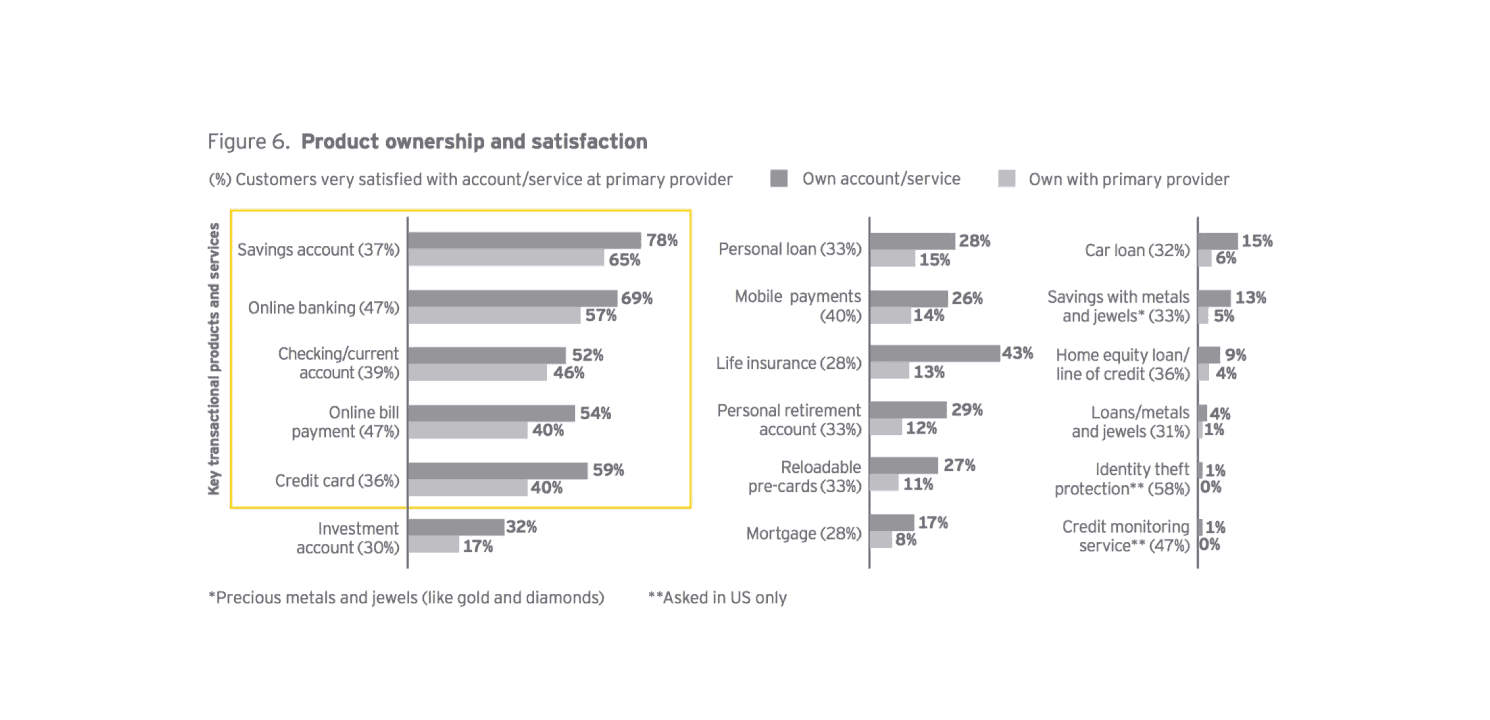

Now, let’s take a look at products. According to this graph, customers are most likely to have savings accounts with the PFSP. The rest of these products have room for improvement.

These results are supported by the graph below as well, which addresses the satisfaction level of customers with products they currently have with their PFSP. Savings Account satisfaction is high, which makes sense why most people would have them with their PFSP as the first graph indicated. But, you can see that the numbers for other products, especially those that could bring in capital, such as HELOC and Auto Loans, aren’t as promising. We’ll address those numbers later in this article.

For now, let’s look at the good: savings account, online banking, checking account, online bill pay, and credit card products are all predominantly held with the customer’s PFSP. Be sure to continue to support and advertise these products to your customers.

Online bill pay, in particular, is an important product to look at in relation to customer retention. A study conducted by Bank of America a while back showed that Online Bill Pay customers had an 80% higher retention rate. They were also more likely to adopt other additional products with the bank.

Make sure your existing customers, who aren’t currently enrolled in online bill pay, know that your institution offers this benefit. You could do so through an email or print campaign. We recommend a combination of both email and print to ensure your communication is actually reaching 100% of your intended audience.

Here’s an example of a postcard your bank/credit union could use to promote online bill pay adoption. You can download this and other free templates from our resource library.

Opportunities for Improvement

Now that we’ve seen the good, let’s look at what could use a little improvement. The three sections of the graph below show what benefits fell below average satisfaction in customers’ eyes.

The graph on the left pinpoints that customers aren’t satisfied with benefits their PFSP offers relating to advice. These benefits, however, also rank relatively low on customer importance.

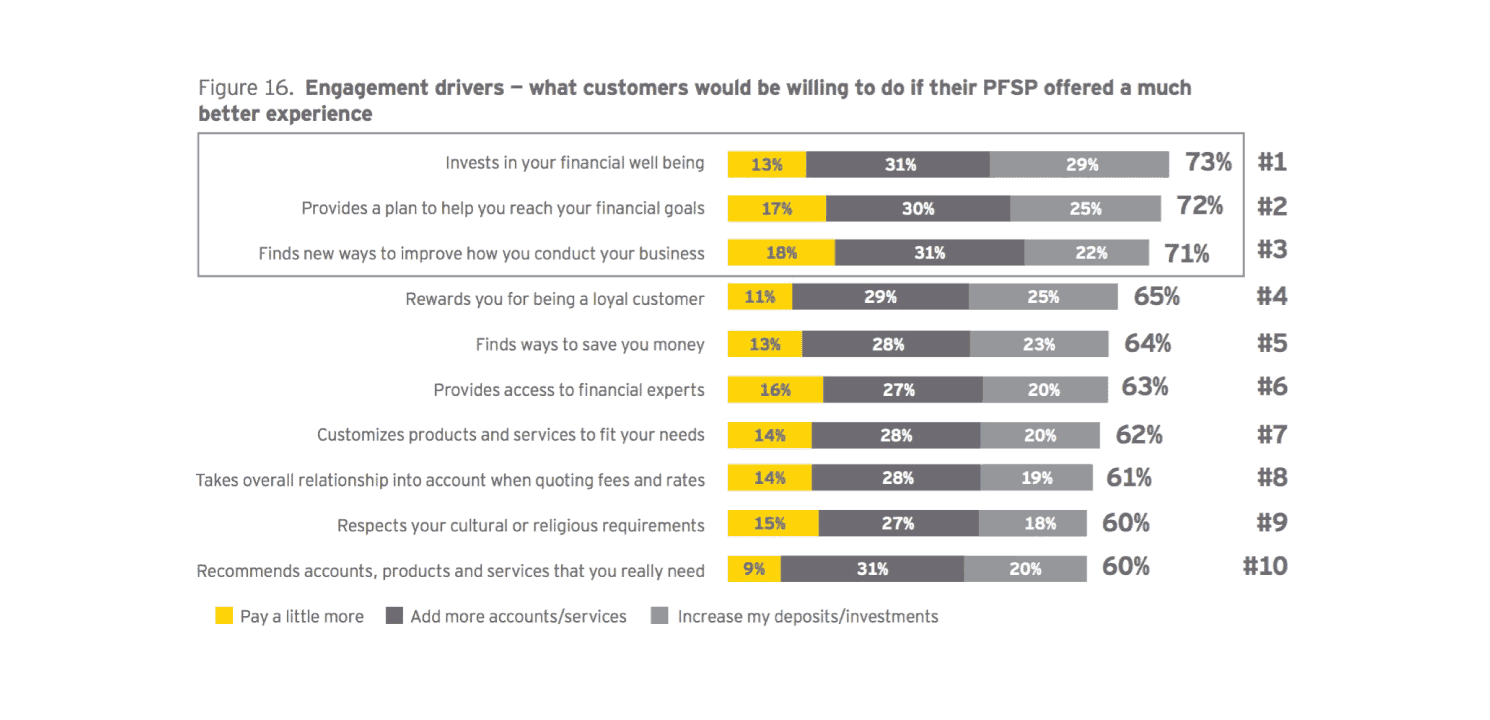

This doesn’t mean we should ignore them, though. Another graph in the report shows that the top three benefits that would drive engagement and increase customer’s willingness to pay a little more are all related to these advice benefits PFSPs are falling short on:

Creating meaningful customer engagement isn’t a simple matter. It requires in-depth knowledge of your customer. This can be accomplished by having access to a full view of their accounts, past communications, and any open opportunities they may have with an institution. PFSPs will need access to information like this in order to make informed decisions and communicate best options to their customers. If PFSPs can accomplish this, they could begin to improve their advice satisfaction scores, customer engagement levels, and perhaps even encourage customers to invest more because of the relationship they’ve now built.

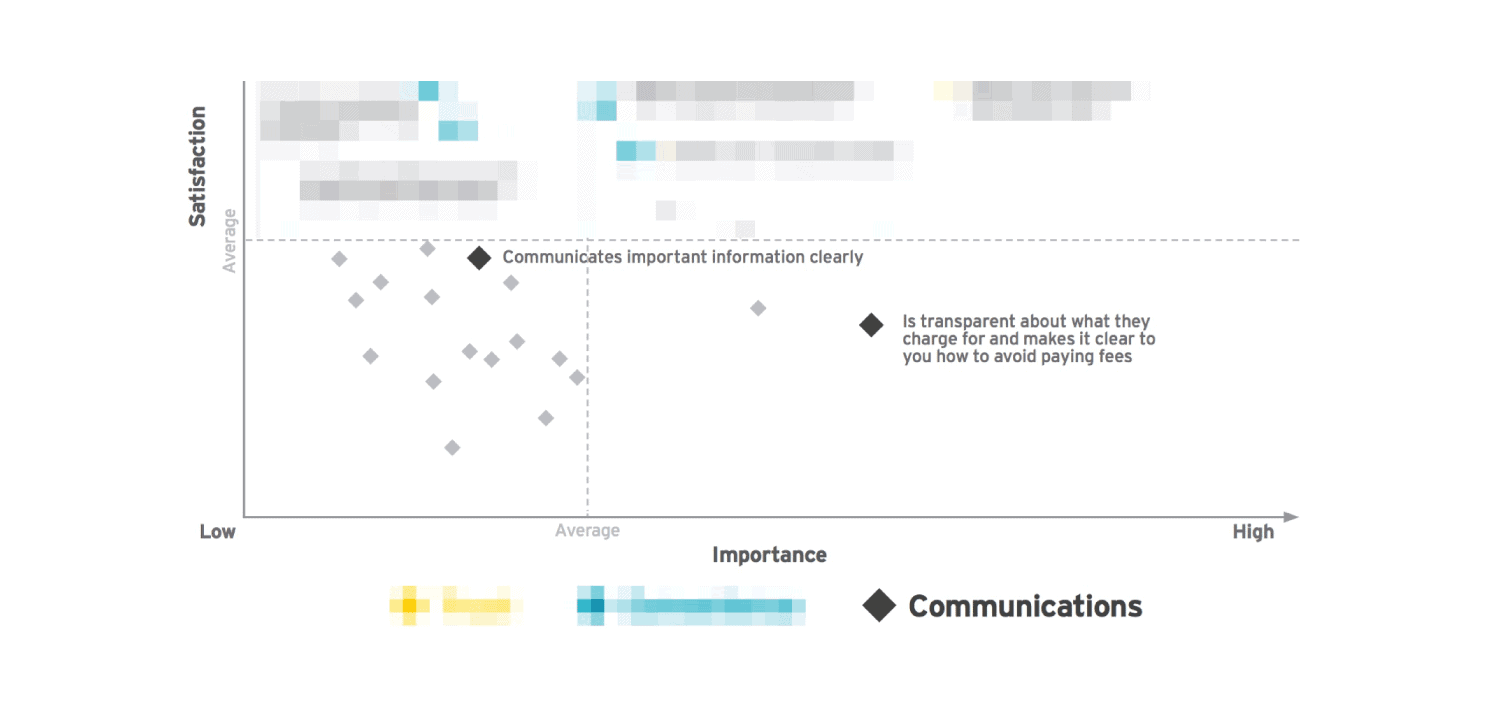

Looking at the middle graph we can also see below average satisfaction scores for certain communication benefits as well.

The benefit titled Is transparent about what they charge for and makes it clear to you how to avoid paying fees in particular is an issue because it is the 4th most important benefit to customers. It is well below average. This is a very important issue PFSPs need to address. If this is the type of information customers want to hear from their PFSP then they should be receiving it in a way and time that benefits them. Although they are most likely introduced to all this information when they first open an account, making sure notices such as delinquency reports or balance statements are sent and received at the appropriate time is key. Using automated marketing tools, you can set up trigger events that can send these communications out automatically, helping to ensure their timely delivery. Customers aren’t likely to get annoyed when they’re receiving advice from the PFSP that tries to help them save money. So, don’t be afraid to communicate these types of issues more than once. It will likely raise your customer satisfaction and retention rates in the long-run.

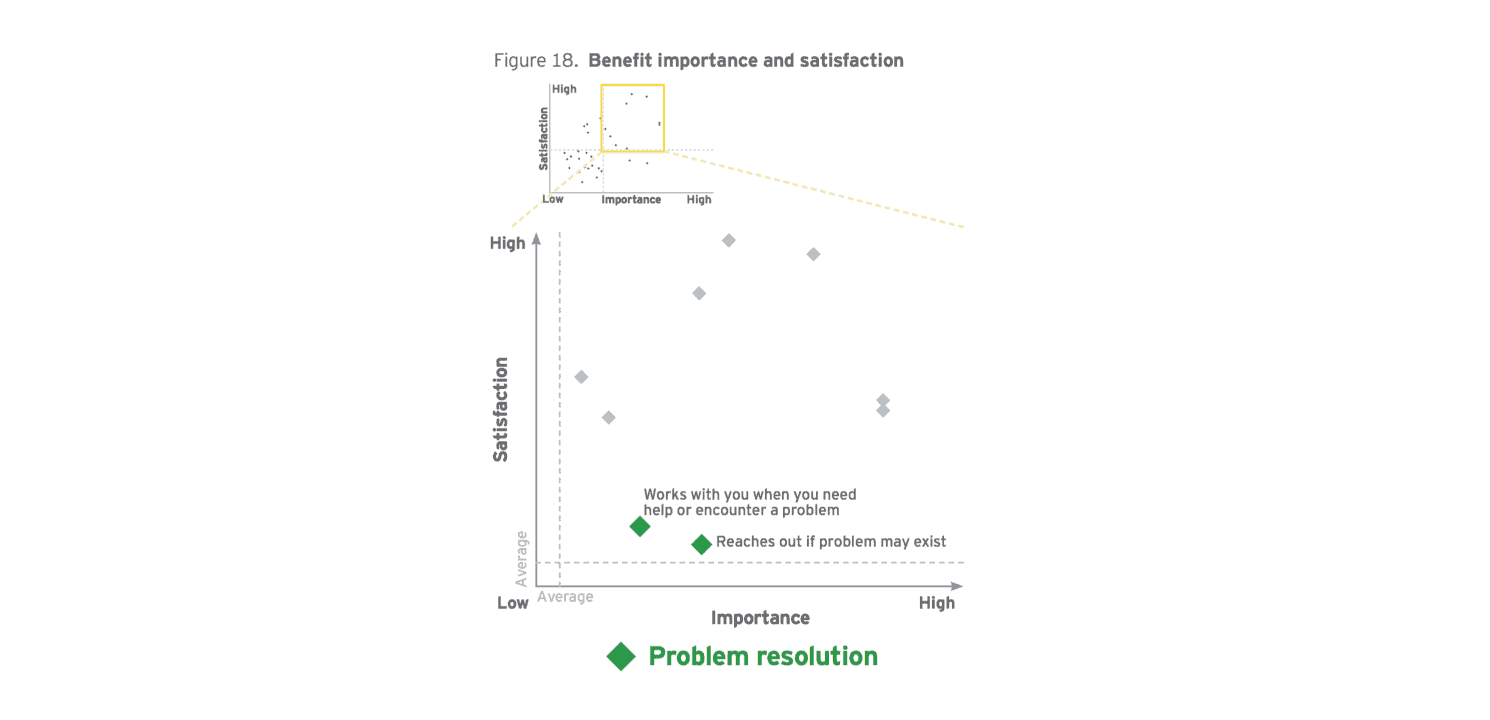

I also wanted to take a closer look at the section of the graph that shows the results for problem resolution. Now, to be clear, customers did technically say these benefits had above average satisfaction, but only slightly. I personally feel this creates an opportunity that financial intuitions can capitalize on.

Marketing research for various industries has shown that customers have higher overall satisfaction when an issue arose and was resolved in a favorable way than when there are no issues at all. Now, this doesn’t mean that PFSP should in any way try to create issues that they can resolve just to build satisfaction. Trust me, too much can and will go wrong there. But, it does signal to financial institutions how import problem resolution is in building these strong and long lasting customer relationships. Be sure to build a rapport of open communication with your customer base. If they feel comfortable contacting your institution with any issues or misgivings that you are able to solve, it will strengthen the relationship. Also, be sure that your institution has solid problem resolution scenarios in place. If you’re prepared and know how to handle problems quickly as they arise, you are even better positioned to build satisfaction.

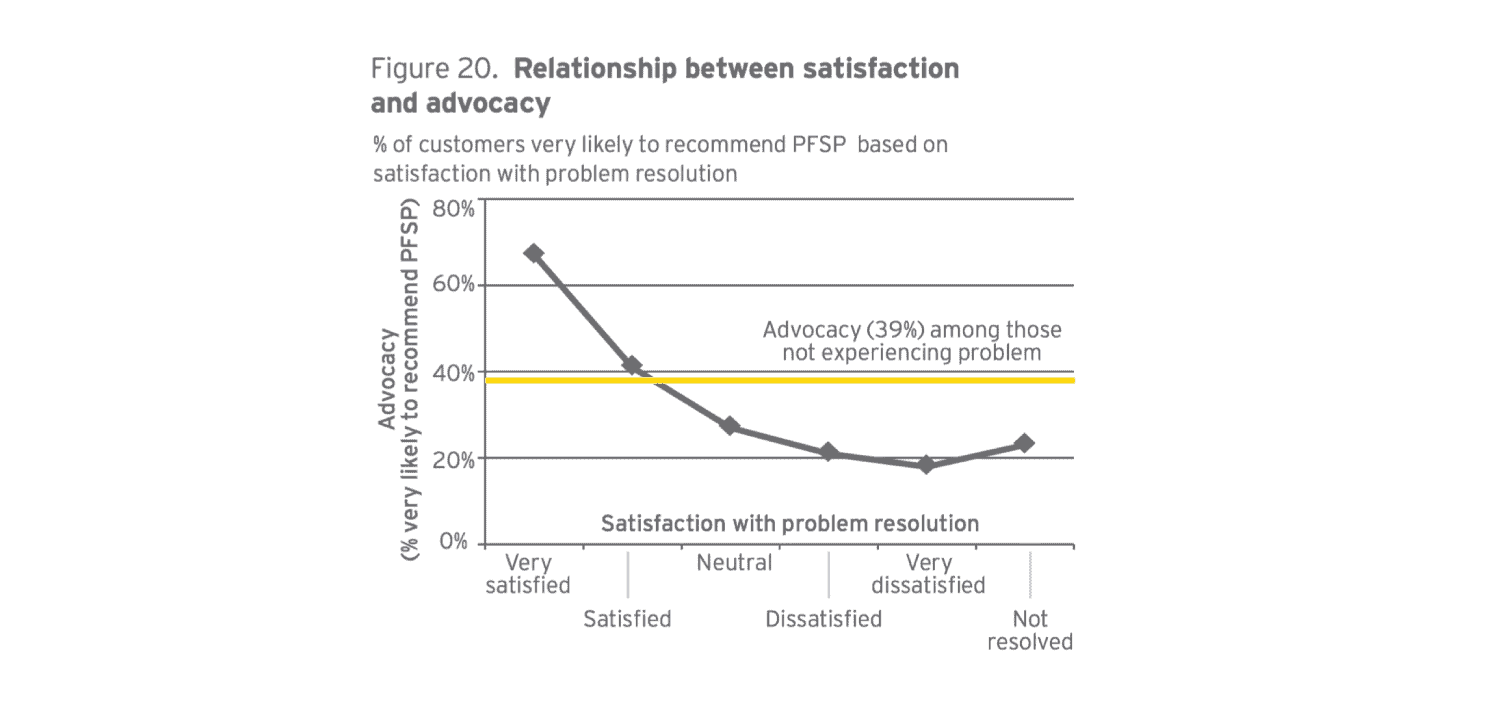

Not only can you improve customer satisfaction through problem resolution, you can also increase the possibility of customers become advocates for your institution. If you don’t believe me, look at these numbers reported in the EY report as well:

Customers are much more likely to recommend their PFSP to others if a problem arose and they were very satisfied with the way it was resolved than among those customers who experience no problems.

Lastly, let’s take one more look at products customers are less likely to adopt through their PFSP.

As mentioned before, the numbers for the majority of products, especially those that could bring in capital, such as HELOC and Auto Loans, aren’t particularly high for PFSPs. Building up the products customers/members have with their PFSP will lessen the chances of them switching institutions as well.

What can a financial institution do to increase these particular product adoptions among customers? Communicate. That’s my recommendation. A lot of your customer base might not be aware that your institution offers these products or are unaware of the rates you offer. Don’t just use email OR print methods, try combining the two. The majority of financial institutions I’ve talked to only have around 40% – 50% of their customers’ emails. Using a print alternative, as I mentioned earlier, can you help you reach 100% of your targeted list.

Also, be knowledgeable about the best time of year to send out certain offers and at what age your customers are most likely to be aging into the need for certain products.

Final Thoughts

Taking note of what customers are saying about their Primary Financial Service Providers is valuable information for any financial institution. Understanding the strengths and weaknesses that exist today can greatly determine what steps you take to build better relationships tomorrow. I hope this information provides you with some insights on how to strengthen your customer relationships going forward and where there are opportunities to grow your business.

Sources:

- Deloitte Center for Financial Services – Kicking it up a notch

- Board of Governors of the Federal Reserve System – Consumers and Mobile Financial Services in 2016

- Zhang, Hong. Customer Retention in the Financial Industry: An Application of Survival Analysis. Thesis. Purdue University, 2008.