People need financial institutions, period. So marketing their services should be easy, right?

As a financial marketer, you’re familiar with the challenges – from limited personnel to combining multi-channel campaigns with cross-sell opportunities. But you’re also familiar with the solution – Core iQ marketing software for banks and credit unions.

Armed with the tools and data you need, you’ve carved out a pretty smooth rhythm. But now you’ve heard rumors of something called a “core provider conversion” coming down the pipeline.

What is a core conversion? How will it affect your communication strategy and what can you do to limit the disruption? Let’s dive in.

Outreach & Marketing Throughout a Core Conversion – An Onovative Guide

Create Your Core Conversion To-Do List

At Onovative, we know that to create an all-in-one automated marketing platform for banks and credit unions, we have to interact with your banking core – your single source of data truth. Naturally, when your core provider changes, our software, Core iQ, has to adapt alongside it.

Here’s everything you need to know about how a core conversion will affect your communication strategy and what you can do to get ahead of it.

To-Do #1 – Let Onovative Know Six Months in Advance

Let’s get one thing straight – a core conversion is a BIG deal. Implementing third-party marketing software with an existing core requires considerable time, energy, and resources – both from Onovative and from internal technical and data personnel. Furthermore, this implementation is core specific, meaning that as the core goes, so goes the effort to integrate marketing tools, like Core iQ.

To limit disruption, the Onovative team asks that you alert us to an upcoming core conversion at least 6 months in advance. This gives us the time we need to coordinate efforts across teams. This also helps us preserve your ability to communicate with accountholders until the very last second.

How Do I Alert Onovative About an Upcoming Core Conversion?

Our clients have several ways to inform us about a core conversion:

- Submit a ticket through Core iQ

- Reach out at su*****@on*******.com

Ideally, we prefer to launch into action with six months’ notice. But we understand that financial marketers aren’t always the first to know. Please, let us know as soon as you can so we can put our own plan in place.

When you reach out, remember to tell us:

- That a core conversion is happening

- Who your new core provider will be

- When your conversion is scheduled for completion

This information should give us most of what we need to start coordinating with other teams and providers.

To-Do #2 – Put a Communication Plan in Place

Financial marketers know the pattern – you push car loans in spring, mortgages in summer, and nearly any loan once interest rates fall. These seasonal opportunities are vital to your institution and your customers, but you’ll also need a strategy to communicate any conversion-related data access and outreach hiccups to accountholders.

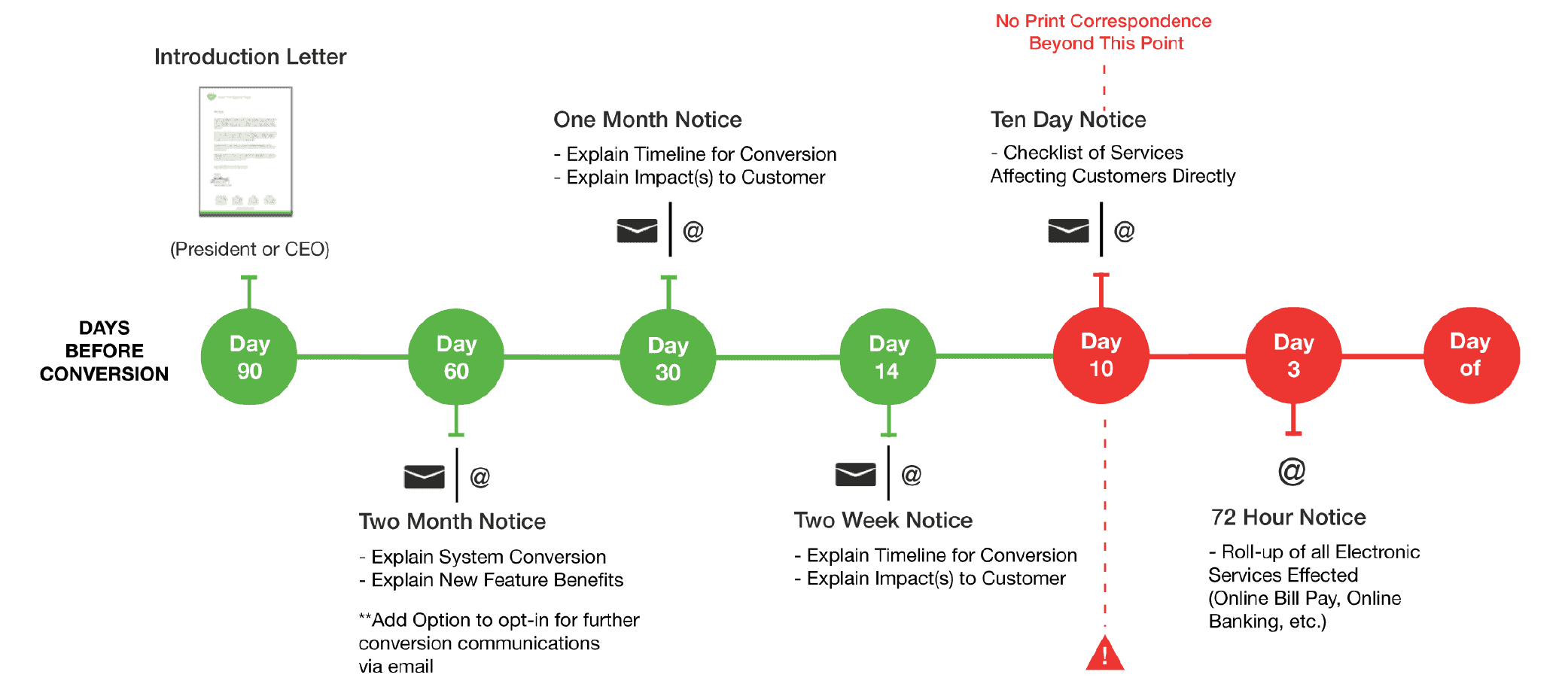

By combining print and email channels at strategic moments leading up to the conversion, you ensure that the news gets out alongside your existing campaigns. Here’s our suggested cadence of print and email communication in the months before conversion.

To-Do #3 – Bring Your Core Conversion Representative into The Process

We honestly can’t overstate what a BIG deal core conversions are. They disrupt your existing campaigns, make it harder to draw insights from core data, and can even interrupt everyday communications with accountholders. But the implications don’t stop there.

A core conversion may also change important data points that are mapped into Core iQ, like:

- Branch codes

- Service codes

- Employee numbers

- Product codes

- Other unique identifiers

These changes will cause serious reverberations for both your institution and your marketing efforts. To get the information you need and ensure the smoothest transition, it’s vital that you bring your core conversion representative into discussions with Onovative and other providers.

Marketing and cross-selling don’t stop during a conversion – they just get trickier. Together with your core conversion rep, the team at Onovative can keep you communicating up to the last possible moment.

To-Do #4 – Coordinate With Other Third-Party Data & Software Providers

Even if you do everything right during a core conversion, you should still expect snags, glitches, and the testing needed to fix them. The more groundwork you do ahead of time, the easier the transition will be and the sooner you can get back to marketing your services.

Across the board, communication is key. That includes your core representative, the Onovative team, and any other third-party data or software providers you use. When everyone works together on a core conversion project, the chances of a successful relaunch increase.

Communicate with your accountholders. Communicate with Onovative. And communicate with other providers – all while bringing your conversion rep with you to synchronize efforts.

Let’s Work Together to Get You Up, Running, & Marketing Again

Core conversions are far-reaching, highly technical, and incredibly complex – even for the financial marketers who depend on core data and Core iQ. With advanced notice (6 months, ideally) and abundant communication, you can get that much closer to resuming the campaigns you’ve worked so hard to build.

At Onovative, we know the challenges of financial marketing. That’s why we built an automated marketing platform specifically for you. Thankfully, we also know the intricacies of core conversions and how to help you and your team rise above the challenge.

Don’t forget to browse our list of free core conversion resources, including postcard templates, letter templates, and educational resources for your accountholders.

Don’t Let a Core Conversion Scare You. Trust Onovative to See You Through!

Built exclusively for financial marketers, Core iQ is designed to integrate directly with your core banking system. It’s only natural that changes to your core require changes to your automated marketing software platform. If you know a core conversion is in the works, don’t wait. Contact Onovative today so we can see you through.