Figuring out the best time to offer your IRA savings accounts and who to send your offers to can help you maximize deposit growth. Fully understanding your account holders behavior is essential to meeting your annual deposit growth goals.

Here are 3 things to consider when building your IRA promotional campaigns.

Timing IRA Savings Account Promotions

Knowing how to get the right offer into the right person’s hands at the right time is half the battle in executing your promotional campaigns. That’s why I like to recommend using an awesome free tool, Google Trends, to help get you started and give you some concrete insights into timing your product offers.

Google Trends shows you the relative interest of a specific product over time, allowing you to pinpoint patterns and note exactly when the majority of people are searching for a particular product. What’s even better – you can narrow the data down to your specific metropolitan statistical area (MSA) and week of the year.

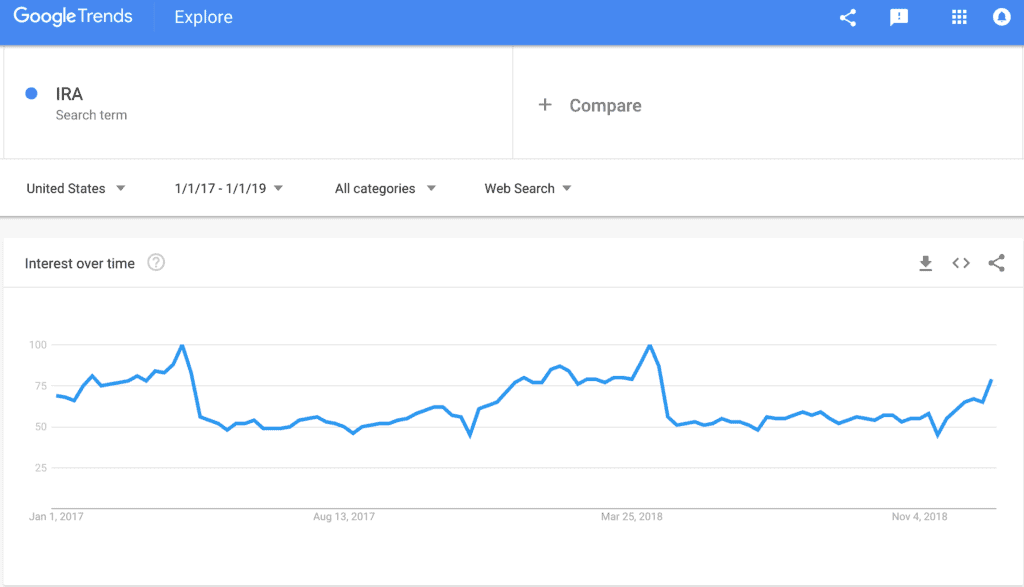

In this instance, we’re going to look at the term “IRA” and set the time period to the last two calendar years. As you can see, there are two very obvious and clear spikes on the graph that indicate the highest volume of interest:

- April 9-April 15

- April 8-April 14

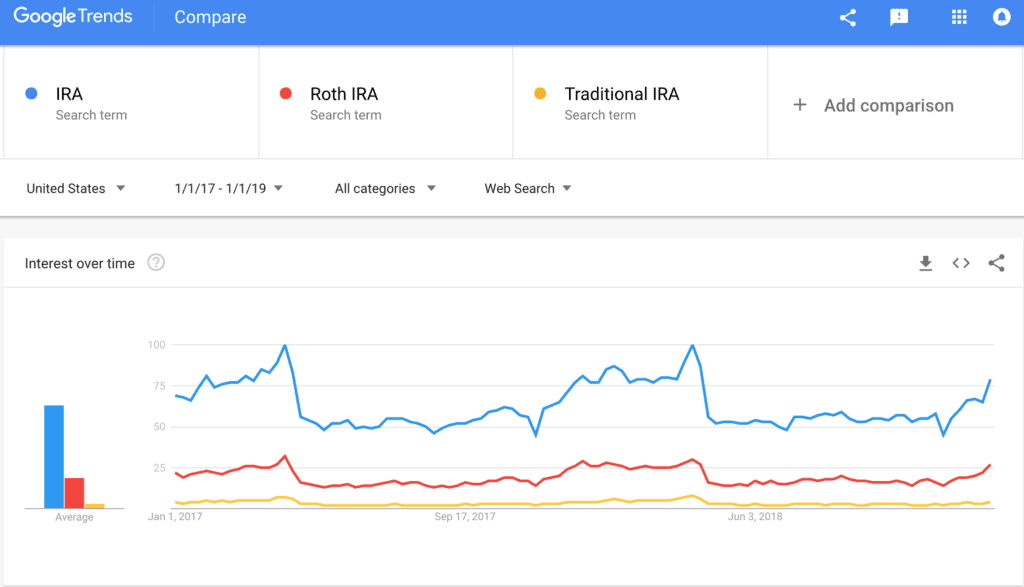

I typically suggest to plug in a few different terms that consumers may search for when researching a particular product as a comparison. Here, I’ve added “Roth IRA” and “traditional IRA”, specific IRA accounts your relationships may be looking in to.

Here, you can see that, although the term “IRA” has the overall highest search interest volume, the other two search phrases follow the same overall pattern in interest. This is a good sign that indicates the beginning of April is when most people are looking into opening an IRA. Consider this when building your campaigns and begin promoting them before the first week of April.

IRA Savings Account Campaign Content

The next step in building your IRA product offers is determining what to include in your offer. For this, I like to utilize another great tool that all marketers should have at their fingertips, a keyword research tool. I like to use Moz, but you can also use Google Adwords for this step.

Keyword research tools allow you to see how often a search term or phrase is searched for in Google each month. I like to take advantage of these types of tools to learn more about what consumers care about when they are researching specific products. This way, you can know what kind of content will be helpful to include in your product offer promotions.

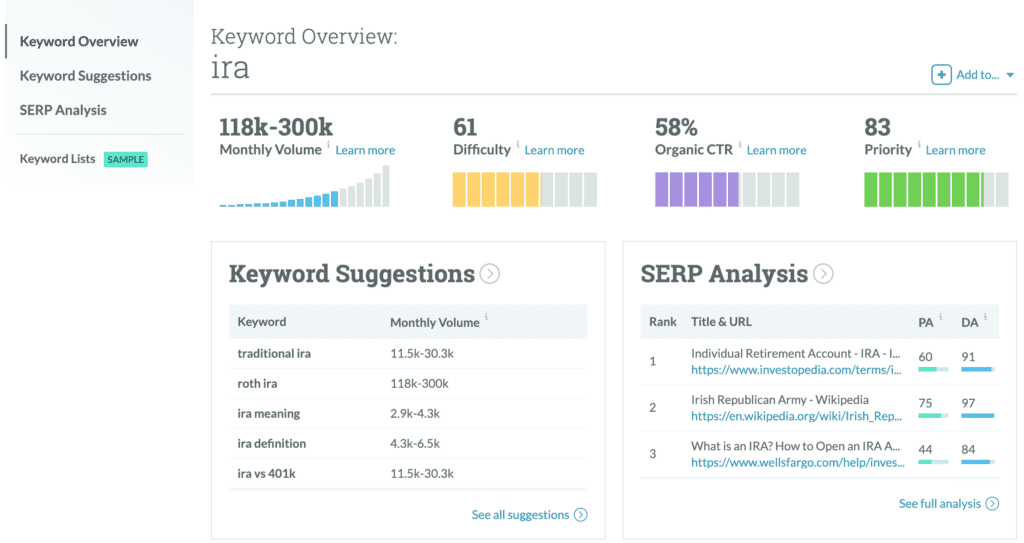

Start by plugging in the product you wish to research. In this case, “IRA”. You keyword analyzer is not only going to show you the search volume for “IRA” but also offer related suggestions that people are searching in Google along with those search volumes.

Here’s what we’ve learned regarding search volumes for “IRA”:

- IRA – 118k-300k

- Traditional IRA – 11.5k-30.3k

- Roth IRA – 1118k-300k

- IRA meaning – 2.9k-4.3k

- IRA vs 401k – 11.5k-30.3k

From this, you should consider offering plenty of education and clarification on the differences and benefits of each type of IRA savings account your financial institution offers, what exactly an IRA is, and why your relationships should consider opening one.

Analyzing Big Bank Examples

Lastly, I like to look at what some of the top banks are doing in regards to promoting IRA savings accounts for additional ideas and validation of what content and strategy will work for your IRA product offer promotions.

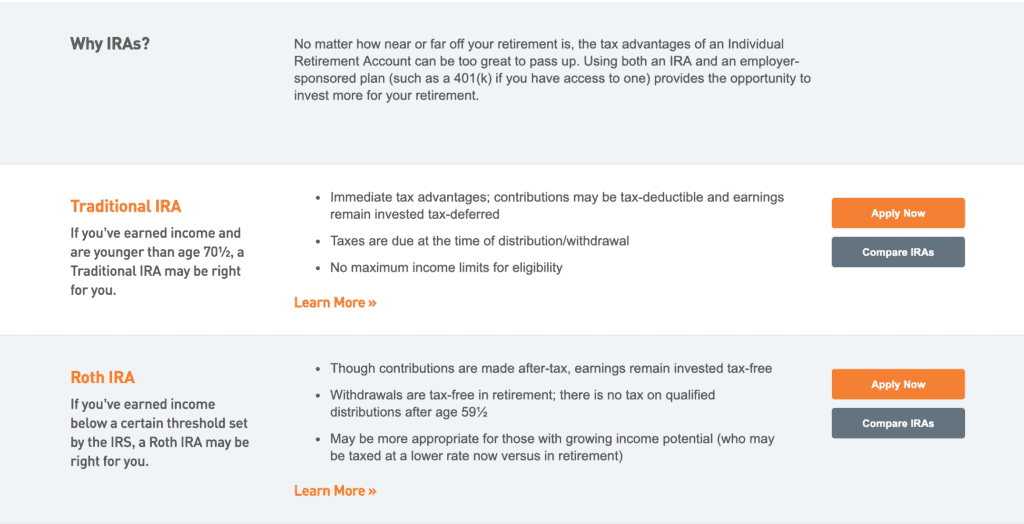

PNC Bank

PNC’s IRA savings account page offers a clear layout of the features of Traditional IRAs versus Roth IRAs. This distinction can help your relationships determine which type of IRA account will fit their specific retirement goals and needs. They also emphasize why opening an IRA and beginning a retirement savings account is important, and ensure that IRAs are a good idea for relationships of all ages who wish to begin planning for their future retirement.

BB&T Bank

I particularly like the way BB&T promotes their IRAs with a simple tagline – Set your course for a brighter future. This is a successful way to appeal to your relationship’s needs and encourages them to start thinking about and planning for their future after retirement. It’s simple, to the point, and with a clear call to action.

Bank of America

Two things to note with the way Bank of America promotes their IRA savings accounts. They emphasize “wherever you are in life”. This is important to consider when building your target audience for your IRA product offers. Relationships in their 20s and 30s are a great target audience for your IRA savings accounts. Create messaging that appeals to this age range and prompts them to start considering opening an IRA account to begin their road to retirement. Secondly, Bank of America offers multiple resources that are helpful to their customers when it comes to understanding planning for retirement, how to determine how much to save, how to set up a savings plan, and several additional tools that are helpful in guiding their customers towards successful retirement saving.

Consider revising and revamping your IRA product offer campaigns using these three strategies and you will be certain to find success and increase your deposits to reach your individual deposit growth goals.

For more strategies on building product offer campaigns, head to our free marketing insights for banks and credit unions or sign up for a quick demo to see how Core iQ is helping bank and credit unions reach their deposit goals through automation, onboarding, and communication platform.