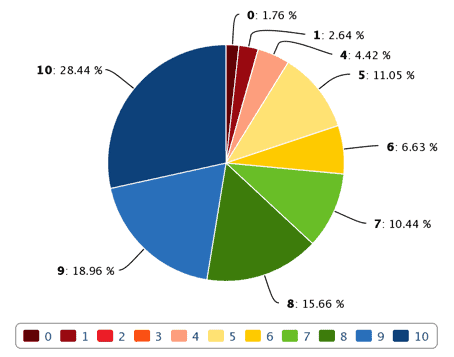

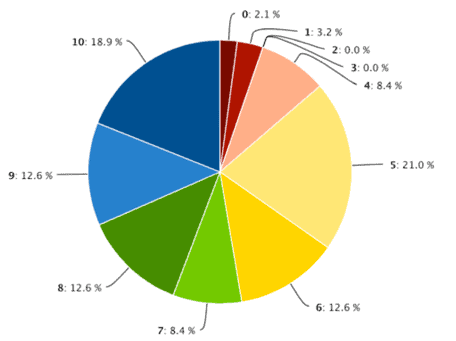

According to our most recent survey of more than 1000 customers of banks and credit unions, customers earning more than $75,000 per year are significantly less satisfied with the quality of the mobile banking app provided by their financial institution than those earning under $75,000. The survey found that customers living in rural areas tend to rate their mobile banking application higher than those living in suburban or urban areas. Overall though, the majority of consumers rated the quality of their mobile banking application highly. The customers recorded their answers on a scale of 0(very poor) to 10(excellent).

Our last survey on mobile banking app usage indicated that about 15% of customers use a mobile banking app. This percentage is expected to rise significantly over the coming years as smartphone usage increases. Community banks should be asking their highest income customers what features they would like to see in their mobile banking application that isn’t currently present. As more consumers use their smartphones to interact with their banks, keeping the most profitable customers happy will be increasingly important.