When it comes to checking accounts and checking account products – what is it that people care about? If you’re planning a new checking account campaign or refining your current checking account campaigns, this is an important insight to understand. Especially if you want to send hyper-targeted campaigns that drive conversions.

Know What Your Audience Cares About

Performing keyword research using tools like Moz or Google AdWords during the planning process of any campaign is a great way to learn about your audience’s interests. For this campaign, specifically, we’re going to look at some search queries associated with checking accounts and checking account products.

Since most people already belong to a financial institution for their checking account needs, sometimes it can be a challenge to capture new accounts. However, people do switch banks depending on if they are relocating, getting married and opening a joint checking account, looking for better checking account offers and products than what they’re currently using, etc.

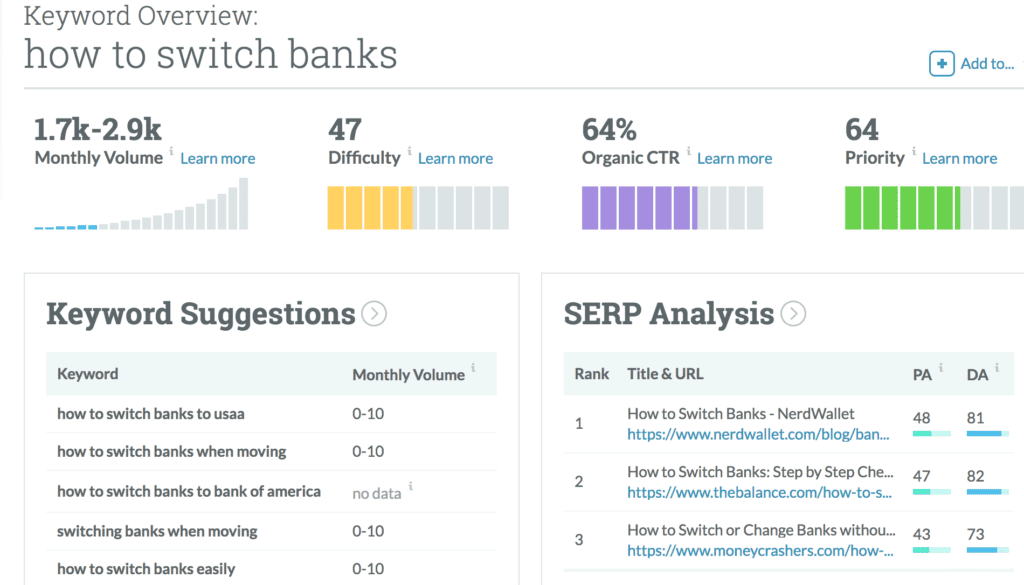

As you can see from the following screenshot, there’s an average monthly search volume of 1.7k to 2.9k for the search phrase “how to switch banks”. Since switching financial institutions can be a hassle, use this insight to your advantage and include content in your campaign that will help educate your customers and members and offer guidance that can ease the process.

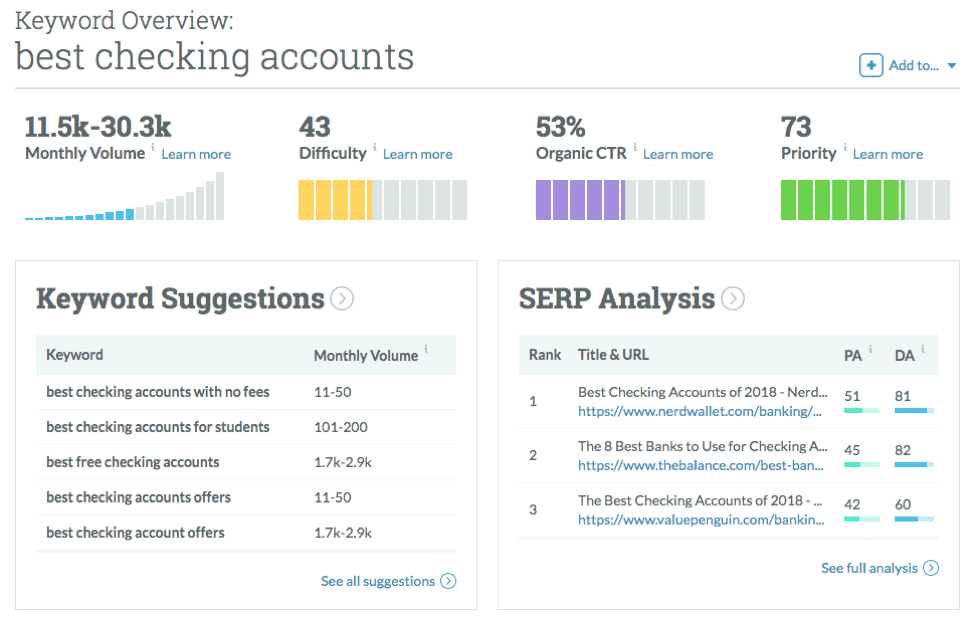

The term “best checking accounts” has a high monthly search volume of 11.5k to 30.3k, which means that a good number of people are searching for the best checking account options on a monthly basis. You can also see in the Keyword Suggestions box that “best checking account offers” is being searched an average of 1.7k to 2.9k times a month. These results are perfect indicators that people are regularly looking for better checking account options and are interested in ones that have the best offers. This gives you, as a financial institution marketer, the upper hand because now you can intelligently highlight your competitive advantage with your specific checking account offers.

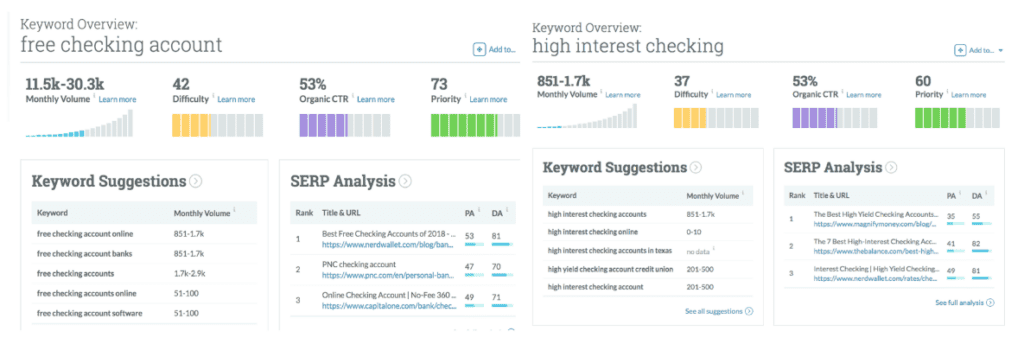

There are two main types of checking accounts that most financial institutions offer, basic or free checking accounts, and interest-bearing checking accounts. Below you can see the difference in average monthly search volume between the two. “Free checking account” has a monthly search volume of 11.5k to 30.3k and “high interest checking” has a monthly search volume of 851 to 1.7k. While it’s obvious that the majority of people are interested in checking accounts with no associated fees or balance minimums, there is a high possibility that you could upsell a customer or member on a different type of account once they learn which account will benefit them the most based on their needs and habits.

When it comes to finding the best checking account, customers and members are paying attention to features and go-with products that your financial institution offers. Based on monthly search volume research, most people are looking for:

- Online banking: 30.3k – 70.8k

- Mobile banking: 4.3k – 6.5k

- Mobile deposit: 2.9k – 4.3k

- Online bill pay: 851 – 1.7k

Using this data on monthly search volumes, you can now begin to strategically craft your campaign messaging strategy to capture new checking accounts. Not only can these insights help you win totally new checking account relationships, but you will also be able to prioritize your cross sell offers to your current relationships based on this search volume data.