Working closely with our customers, we have found that it is very challenging for financial institutions to overcommunicate with their relationships – especially if they’re taking the time to send timely, targeted offers and messages that help with building relationships. In fact, our customers consistently see opt-out rates for product offers below 1%!

As a best practice, we stand by the strategy that the more communications you’re sending, the more engaged your customers or members will be – again, as long as you’re sending relevant offers and messages.

So, on top of your regular onboarding schedules and engagement efforts, one of the best ways to ensure relationship expansion across loan and deposit products is by executing regular, targeted cross-sell offers.

Cross-selling is key because it’s a fundamental way to achieve two very important goals:

1. Drive loan and deposit growth

2. Build loyal, lasting relationships

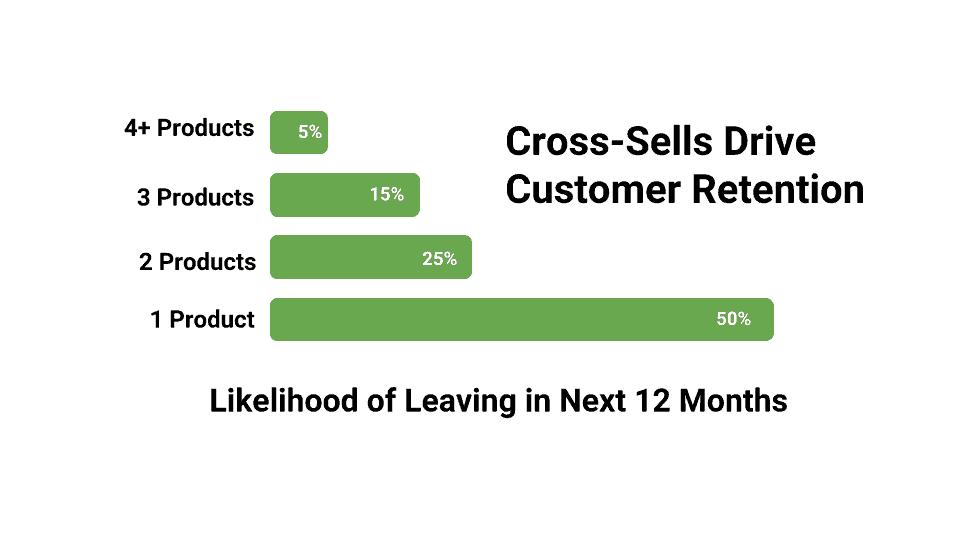

According to a study by Deluxe, the more products a relationship has adopted, the lower the chances are they will leave. Customers or members with 4 or more products with your institution have a 5% chance of leaving, whereas a customer or member with only 1 product has a 50% chance of leaving.

As part of most onboarding programs, FI marketers tend to begin cross-selling at the 30, 60, and 90-day mark. Following your initial onboarding schedule, we highly recommend continuing to send regular, targeted cross-sell offers to your relationships.

But how can financial institutions build a world-class cross-sell program that will drive results? Well, let’s start with some basics.

1. Low hanging fruit

Promoting go-with products to your relationships who open new accounts is usually done within those first 90 days of account opening. However, it’s important to continue pushing those products to help your relationships fully adopt the products they already have with you. Not only will it make their banking experience easier for them, but it will also ensure that they will use the products they have. These go-with products include things like direct deposit, bill pay, online/mobile banking, and eStatements.

2. Keep the conversation going

What good is a relationship without communication? Exactly, so don’t stop at onboarding. Your goal as a financial institution is to empower and assist your relationships in making healthy financial decisions through the use of your expertise and products. One great way to achieve this and to assist your cross-sell offers is by coupling your offers with financial education resources. Not only will this build trust between you and your relationships, but it will ready them to make purchasing decisions when it comes to your products.

3. Understand your relationships’ needs

Sending the right offers to the right people can make the difference in whether or not your cross-sell efforts will be effective. Your front-line employees are a good filter for feeling out what interests or needs your customers or members have. Be sure you have a system in place to be able to track conversations of note and to quickly queue up offers to go out through your various marketing channels. Another easy and effective way to accomplish this is to conduct an annual financial needs assessment. This can be a way to gauge what your relationships care about over the next 6 to 12 months.

4. Send relevant, timely offers

If you want your cross-sell offers to be targeted and effective, you don’t want to simply blast all relationships with the same cross-sell offer regardless of their current product adoption or behavior. While you do want to prioritize a list of products you wish to promote, you should also take into consideration the likelihood that a particular relationship will adopt a particular product. Look for similarities in your relationships across demographics and behaviors, and see if you can apply this persona to find other customers or members that look the same. For example, if most of your relationships that have checking accounts also have a savings account, find those relationships with a checking account without a savings product, and send a savings product cross-sell offer. Analyze the products your customers or members have and don’t have and send cross-sell offers that make the most sense for them.

Different Cross Sell Ideas

Here are some different ideas for setting up your cross-sell offers.

Quarterly Cross-Sell by Account Type

Start by segmenting your relationships by product type – transactional, deposit, loan. From there, you can set up different cross-sell priorities that will be most applicable to that particular audience.

Transactional

First, start with all of the checking account transactional go-with products. Once they have fully adopted that lense, consider cross-selling them into other deposit products. Start with savings products like CDs, Money Market Accounts, or Regular or Premier Savings Accounts. Are they eligible for high-interest checking? Consider an up-sell as a cross-sell. Lastly, start to begin cross-selling your different loan products.

Deposit

Target those relationships with a current savings product and cross-sell other savings products. Do they have a regular savings account? Consider cross-selling a CD promotion, or an IRA account. Once you’ve expanded the relationship within other deposit products, start to introduce cross-sell offers for your different loan products.

Loan

Segment out all of your relationships that have loan products and begin cross-selling other loan products. If you have a customer or member with an auto loan but no other products, consider sending a credit card or personal loan offer. Once you’ve sent cross-sell offers for your additional loan products, then consider cross-selling your deposit products like checking and savings products.

VIP Cross-Sell

Set up a cross-sell automation that sends a series of special offers to your qualified, high net worth relationships. This is a great way to make your VIPs feel like VIPs. Consider offers like your Premier Savings Account, 0% APR Credit Card, or Rewards Checking. You can define your VIP relationships however seems appropriate for your financial institution, but an example could be relationships with a deposit balance of $100,000 or more or with a loan origination of $200,000 or more.

Seasonal Cross-Sell

If you are aware of a particular time of year that more people are interested in a specific product, use that insight to your advantage by setting up seasonal cross-sells. For example, if you know Summertime is a great time to promote your HELOC products because you know most of your relationships are contemplating home renovation projects, then queue up a HELOC cross-sell offer to go out to all of your relationships with a current mortgage at a specific date in time at the beginning of the summer. If you know the holidays can be a stressful time of year financially, and you know your relationships could benefit from a personal loan to finish up their shopping, consider setting up a personal loan cross-sell before the holidays.

How Core iQ Helps Achieve Highly Effective Cross-Sells

Onovative customers have developed a clear advantage when it comes to prioritizing and setting up automated cross-sell offers. With Core iQ, banks and credit unions are able to set up automated communication plans that are based on a defined set of trigger events. And since Core iQ pulls data from your core banking system and other 3rd-party or ancillary data feeds automatically and on a nightly basis, it knows the products that each of your relationships has or doesn’t have

This particularly comes in handy when you set up a cross-sell communication plan using the cross-sell priority matrix. Once you’ve defined the audience for your specific cross-sell plan and have identified, based on priority, which cross-sell offer you think is most relevant to that group, Core iQ will do the rest. Core iQ can automatically identify whether a relationship has a certain product, and be able to intelligently ensure that they receive the next most relevant offer.