Building a high-converting auto loan campaign can be tough, so it’s important to look at all of the data you can find when determining what your content and messaging strategy should be. Before we utilize what we have learned through keyword research and search trends, let’s take a look at what we think some of the top banks are doing that works and see how we can fit it in to an auto loan communication plan.

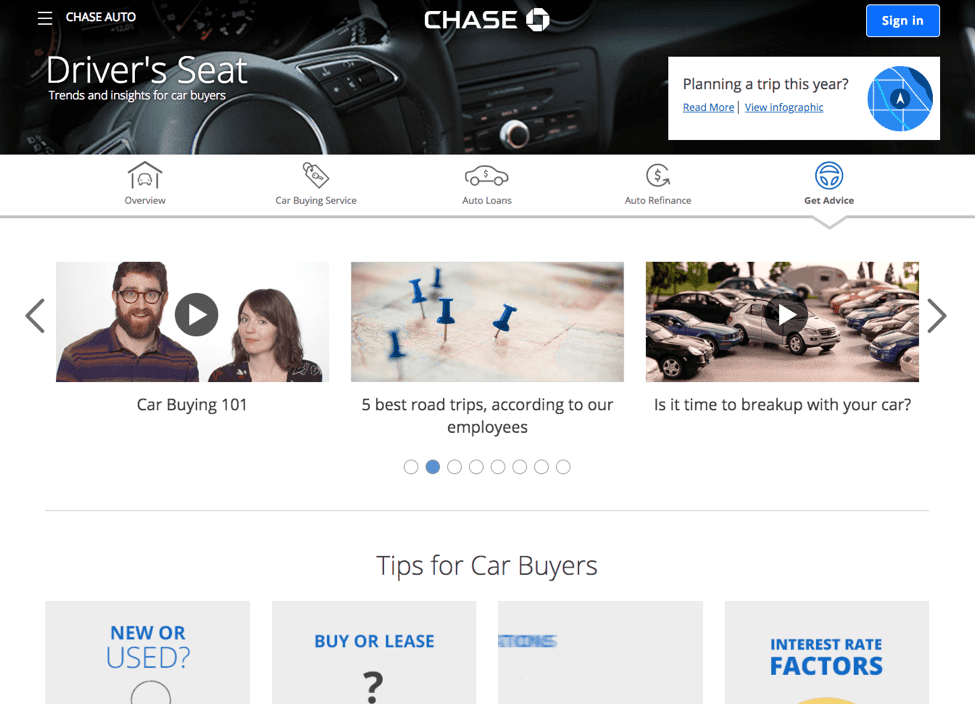

Chase

When you navigate to Chase’s auto loan webpage, one of the high-level navigation tabs prompts you to “Get Advice”, offering trends and insights for the car buyer. There are multiple different resources here spanning from car buying tips to information on whether to lease or own a vehicle. Offering free, educational content like this can be a great resource to first time car buyers and anyone inexperienced with getting an auto loan. Presenting this kind of helpful information can develop a relationship of trust and partnership with potential customers.

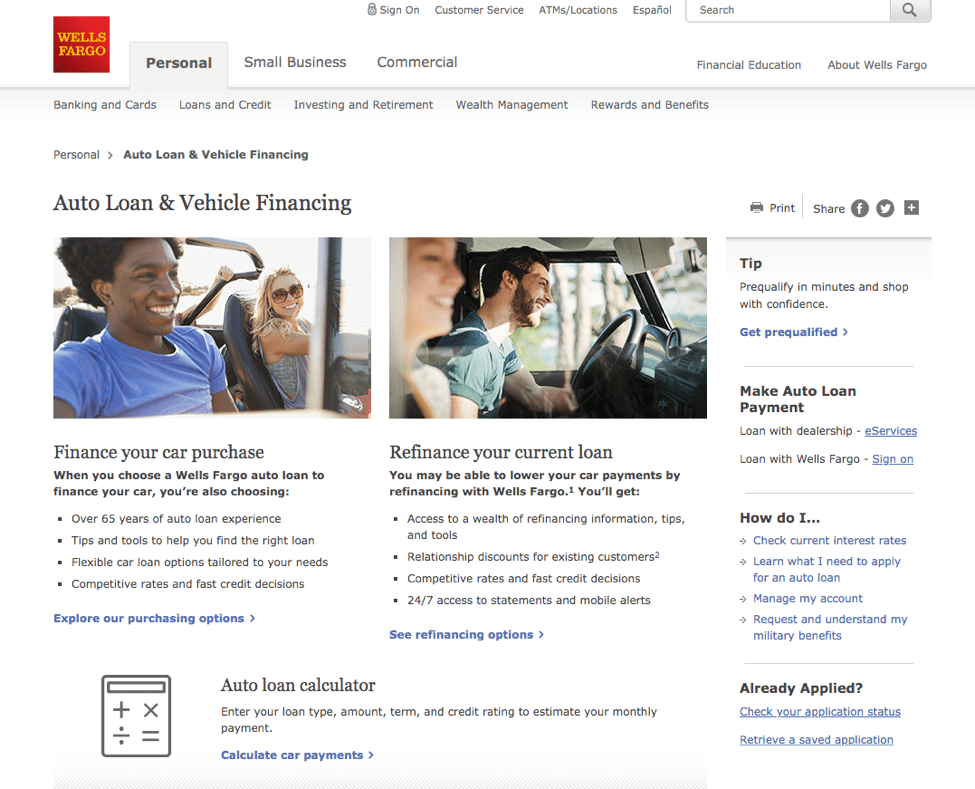

Wells Fargo

Next, let’s take a look at Wells Fargo. Their auto loan home page offers several resources, but one in particular stood out – the auto loan calculator. This helpful tool falls directly in line with the research we gathered through our initial keyword and Google Trends analysis. The highest searched phrases we found were “auto loan calculator” and “car loan calculator”. It’s safe to conclude that a payment calculator should be an essential piece to incorporate into an auto loan campaign.

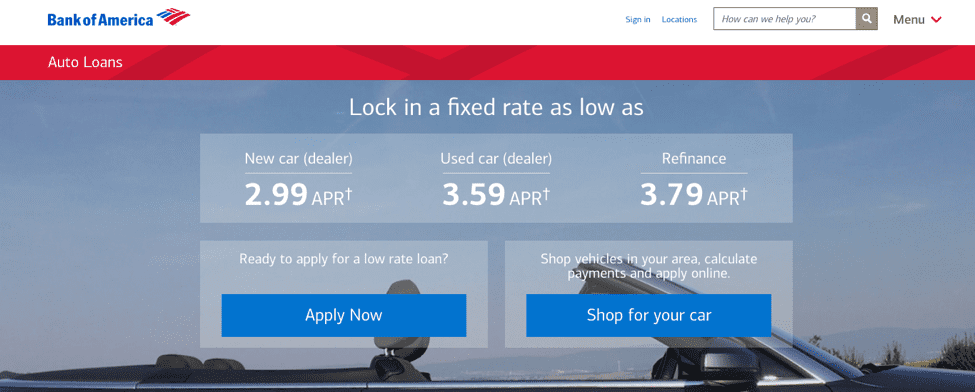

Bank of America

The third and final example we will look at is from Bank of America. As we learned from our previous research, a lot of people care specifically about the interest rates associated with getting a new auto loan. As we can see, Bank of America has come to the conclusion that this is the most important piece to focus on and has made their low rates the most prominent information on the page.

Now that we’ve identified the content top banks are focusing on and what consumers care about when it comes to finding an auto loan based on research and trend analysis, we can use that information to build out an auto loan campaign that is sure to drive conversions.