Building a great mortgage campaign isn’t always about the interest rates you can offer. It is also highly dependent on the timing, message, and audience of your mortgage promotion. If you’re in need of growing loans at your bank or credit union, it’s important to consider the following when building your mortgage promo campaigns.

Message

Now that we’ve determined when the best time to send a mortgage loan offer is, here are my favorite strategies for deciding what information to include in your product offer messaging.

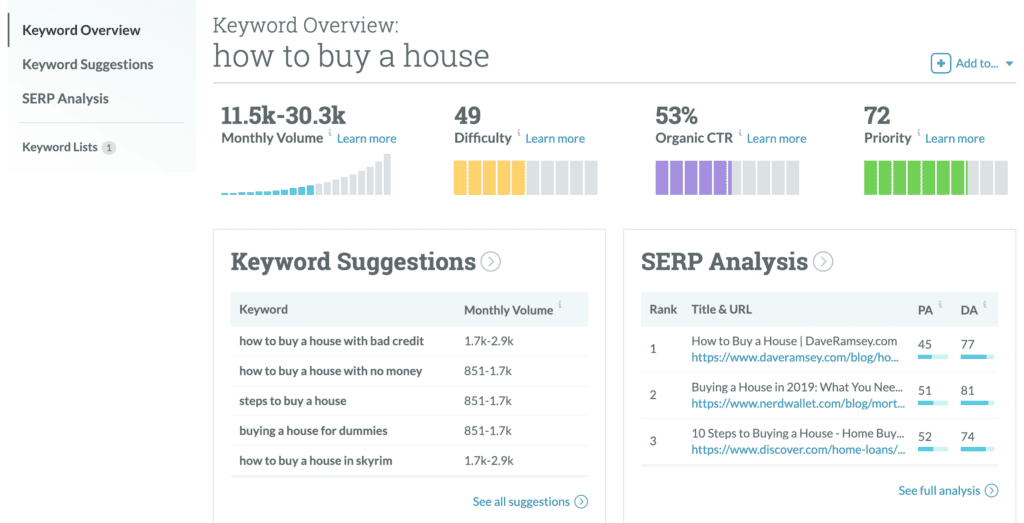

First, I like to utilize another helpful tool that all marketers should be familiar with and do some keyword research. Moz, and other keyword analyzer tools, are helpful in determining the monthly search volume for specific search terms and phrases. This is helpful when trying to understand what is important to consumers when going through the homebuying process.

Let’s first look at the same phrase we used for our timing research. Here we see the average monthly search volume for “how to buy a house” is between 11.5k and 30.3k. The cool thing about Moz’s keyword research tool is you can look at the list of suggestions for similar search terms and see what else consumers care about.

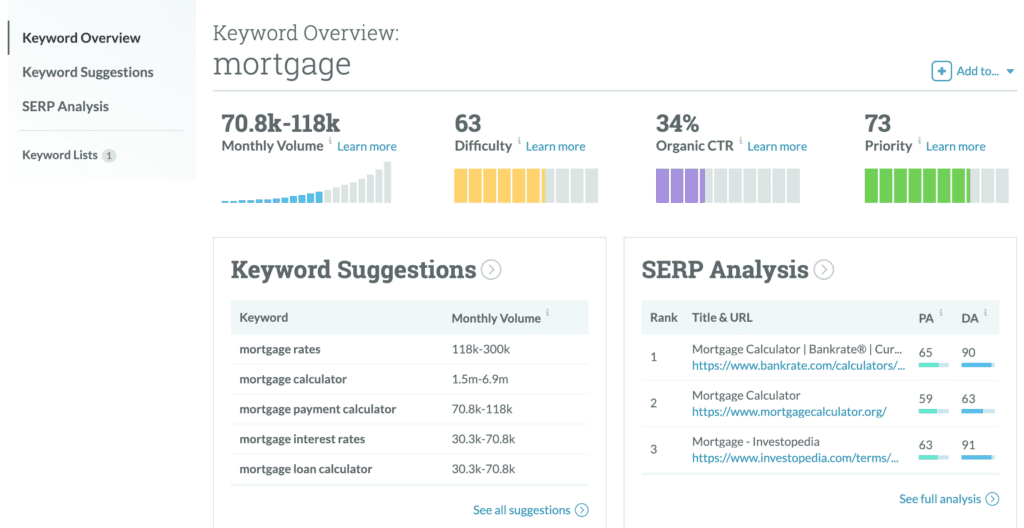

Now let’s look up the term “mortgage” and see what other insights we can uncover.

Notice the term “mortgage” offers different suggestions that will be helpful when deciding what content to include in your mortgage loan offer promotion. From these queries, the top search terms are:

- How to buy a house

- Mortgage

- Mortgage rates

- Mortgage calculator

- How to buy a house with bad credit

This is great information to be sure to include in your campaign messaging, but let’s go one step further.

Another of my favorite strategies for deciding what information to include in product offer messaging is to look at what some of the biggest banks are doing, see if it makes sense to mimic their approach, and see if what we find coincides with our keyword research exercise. Let’s take a look at a couple examples.

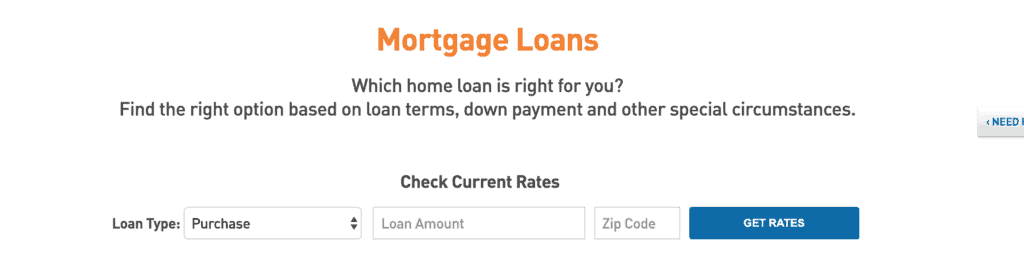

PNC

On PNC’s mortgage lending page, the first thing that is prominently displayed is a mortgage loan rate checker based on location and loan amount. Since we saw that lots of potential home-buyers are highly interested in what the current rates are on mortgages, this would be good information to include in your campaign content.

Bank of America

Buying a home is one of the biggest decisions an individual will make during their lifetime, and because of this, the home buying process can oftentimes be overwhelming for most. So, take into consideration what Bank of America has done by offering resources and tools, particularly for the first-time homebuyer. Offering this kind of information is great for your financial literacy efforts and will help your customers or members know they can lean on you and trust you during this new time in their lives.

Timing

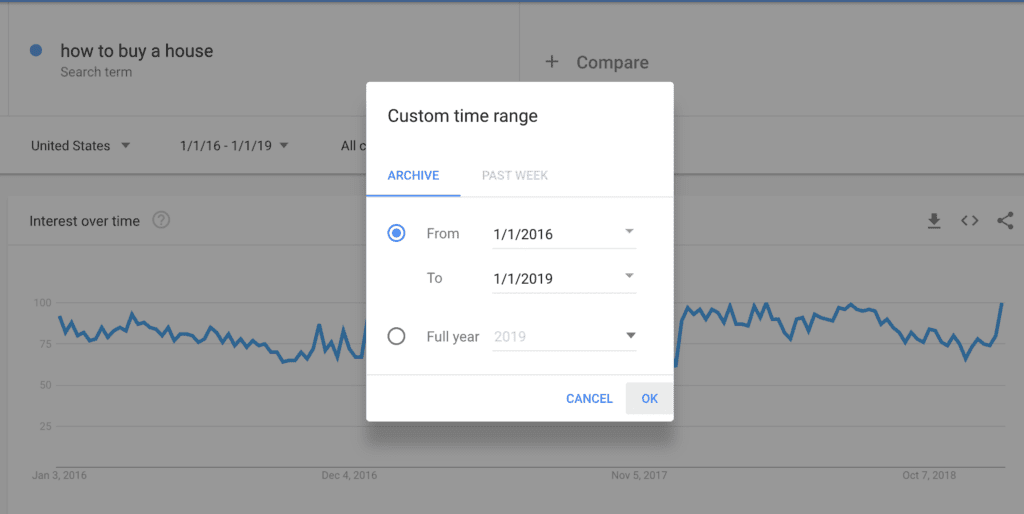

A great, free tool all marketers should be familiar with is Google Trends. Google Trends allows you to look at the interest over time for a specific search term or phrase. In other words, you can search any specific bank product using Google Trends, and determine the time of year most people are searching for, say mortgages, down to the specific week and/or metro area. That’s right – In a lot of cases you can find out when people are searching for mortgages, or any other product, in your specific geographical location. This is very helpful when learning the best time of year to promote a mortgage offer. Once you determine the phrase or term you want to learn more about, you can choose from a selection of preset time ranges. However, in order to get the best data, you should compare at least the last few years. I like to use the Custom Time Range feature and look over the last three years:

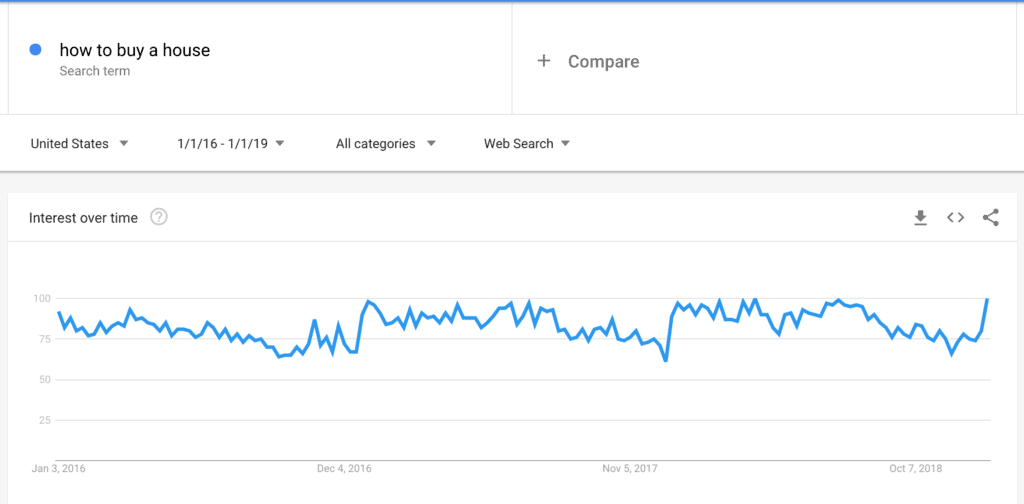

Select terms or phrases you think consumers are searching for when researching mortgages or the home buying process to get started. Let’s look at the phrase “how to buy a house” and see if we notice in patterns in interest over the last three years.

Here, we can see there is a gradual rise and fall in interest of the phrase “how to buy a house” from January through March and then again from June through August. Over the last three years, some of the highest interest in “how to buy a house” was from:

- January 1-7

- February 18-24

- March 18-29

- July 8-14

The lowest interest in “how to buy a house” was from:

- September 18-24

- November 18-24

- March 18-29

- December 17-23

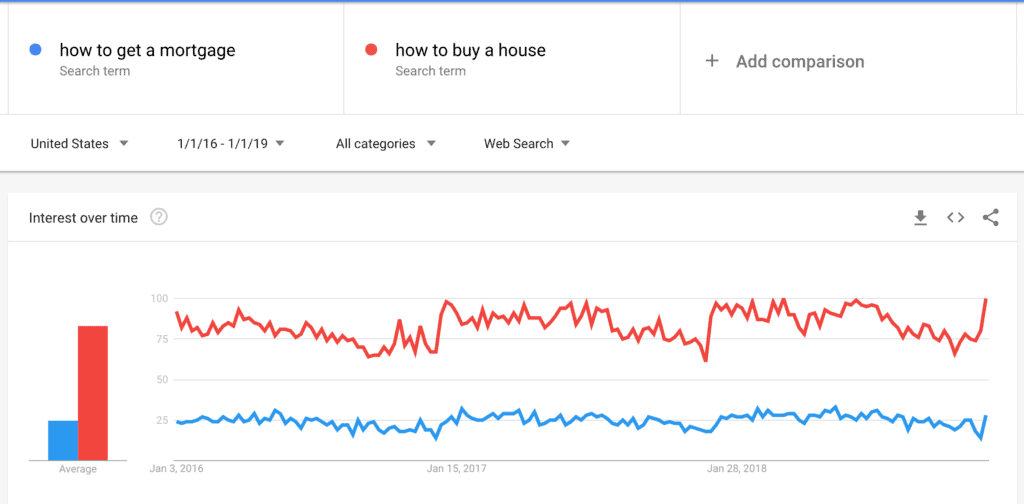

You can also compare multiple search phrases or terms and see if there is any additional insight into when people are most likely to buy a new home. For example, let’s compare “how to buy a house” with “how to get a mortgage”.

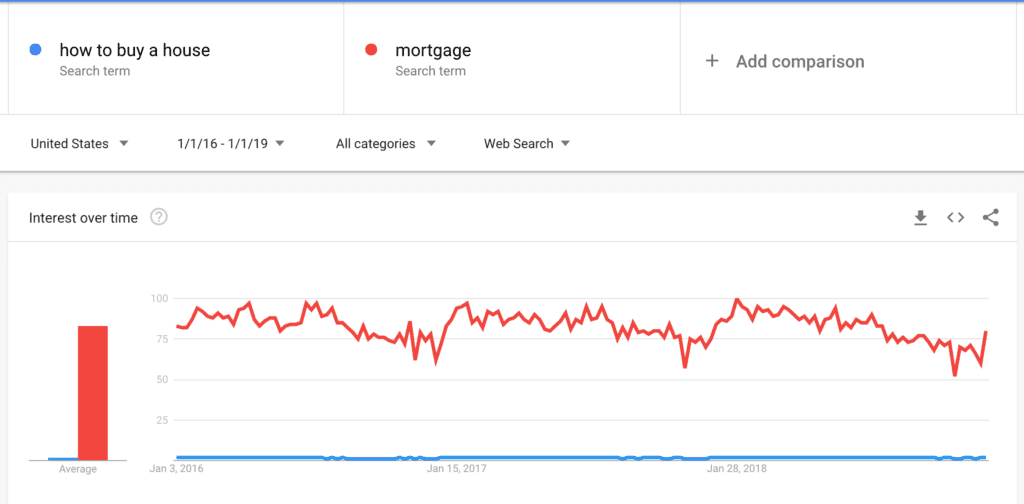

As you can see, the search volume for “how to buy a house” is much higher, but the interest patterns are generally the same month over month. On the other hand, you can compare “how to buy a house” with the term “mortgage”, and notice the search volume for the term “mortgage” is much higher. But again, the overall interest patterns are similar.

From this, you can conclude the the best times of year to promote mortgage loan offers are from January through March, and again from June through August.

Audience

Now that you know when to send your mortgage loan offers and what you’ll include in your marketing messaging, you need to determine your audience and select the most ideal customers or members for your mortgage product offer. It can be difficult to be able to know which of your relationships are likely to be shopping for a new home. The baseline audience can be something like, “people without a mortgage.” But here are some additional ideas:

Annual Financial Needs Assessment – One method we recommend for getting to know the yearly financial goals for your relationships is by sending an annual financial needs assessment survey. This way, you can determine who among your relationships plans to buy a home over the next 12 months or so. This kind of surveying would make it extremely easy to create a target audience based on results, and market your mortgage loan offer.

Credit History – If you don’t currently do a financial needs assessment survey you can build an audience based on criteria you can pull from your core data. If you have a credit score criteria for mortgages, first filter all of your customers or members using your credit score eligibility criteria. According to the National Association of Realtors 2018 Homebuyer Report, Millennials and Gen-Xers made up 62% of homes purchased. Based off of this information, you could segment an audience meeting the previous criteria that are between the ages of 30 and 52.

Customers/Members in Good Standing – We’ve seen the most impact when Core iQ users open up their criteria to include as many people as they can in a given campaign. Excluding people with bankruptcies and charge-offs is a great way to keep your campaigns big enough to make a real revenue impact on the bottom line.

Bonus Idea: Mortgages at Other Financial Institutions – Not a pure mortgage offer, but if you have amazing rates coupled with low/no closing costs – and a way to know which of your relationships have mortgages elsewhere, you can build a mortgage refinance offer geared toward this audience.

Now that you have learned to define the timing, create the marketing message, and build a target audience, you can start promoting your mortgage loan product offers. Using a communication platform, like Core iQ, can help you easily create and send highly-targeted automated communications using data from your core banking system. For more insights on building successful product offer campaigns, contact us at in**@on*******.com or sign up for a quick demo of Core iQ.