Onboarding New Money Market Accounts

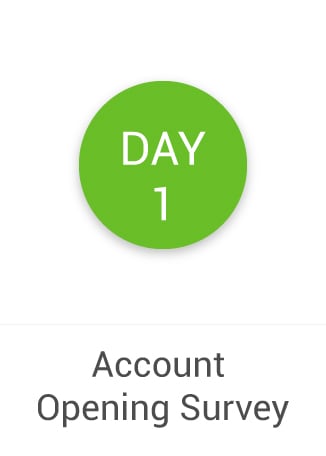

DAY

1

Account

Opening Survey

DAY

2

Account Benefits

DAY

14

Follow Up Phone Call

DAY

30

Account Checklist

DAY

60

Refer a Friend Program

DAY

90

First

Cross Sell

Why Onboard Money Market Accounts?

Onboard money market account holders to increase deposits. People with money market accounts have an interest in getting a higher return on their money. Help these account holders learn how to achieve their savings goals, while working to expand the relationship with additional deposit products.

The first 90 days of the onboarding process should center around product education and then segue into additional savings opportunities.

WHO

WHAT

WHEN

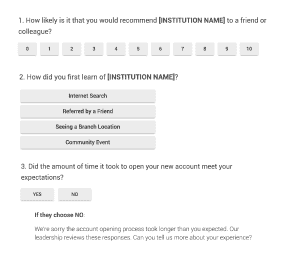

Day 1 – Account Opening Survey & Thank You

Sending a survey immediately after account opening will provide important feedback that can be used for process improvement. It’s a general best practice for enhancing the account opening experience. If survey’s can’t be sent, then a warm thank you message can be used in its place.

TEMPLATES

Day 2 – Getting the Most Out of your Account

This communication should provide everything the account holder needs to know in order to get the most out of their money market account. It’s completely natural for this type of information to include potential go-with products like direct deposit and online/mobile banking for account access.

TEMPLATES

Day 14 – Follow Up Phone Call

After making sure that expectations have been met so far, look to gain insight into the account holder’s savings goals. Don’t be afraid to ask about any other accounts they may have, both inside and outside of the financial institution, to meet those goals.

TALKING POINTS

- Did you receive everything you need?

- What are your savings goals with this account?

- What other savings products are you using to reach your savings goals?

- Is there anything else I can help you with today?

Day 30 – What’s Next

Transition the messaging toward go-with and additional savings product offers one month into the product relationship. Getting a better understanding of the account holder’s savings goals early in the onboarding process, will be key to an effective 30 day follow-up communication.

TEMPLATES

Day 90 – Start Cross-Selling

Onboarding can be considered complete at this point, so continue promoting go-with products and additional savings products that will help the account holder meet their savings goals. Consider a biannual or annual cross-sell cadence to stay top of mind and generate additional deposits.

Promote additional savings products and even time deposit products like CDs and IRAs to increase the deposit portfolio.